In summary

Solana (SOL) remains below $200, down 13% in 30 days, with negative indicators like the Ichimoku Cloud and ADX suggesting weak momentum.

Growing concerns about scams on Solana have fueled debate, with some arguing it’s a result of scale rather than a flaw in the ecosystem.

If SOL breaks through $209, it could rise to $219 or even $244, but failing to hold the $187 support could lead to a drop to $175.

Promo

Trade on BYDFi for a chance to win an iPhone 16, Rolex watch, and more!

Solana (SOL) price is struggling below the $200 mark, currently down nearly 13% over the past 30 days. Despite strong momentum in previous months, recent indicators point to a weakening trend, with bearish signals dominating the charts.

The Ichimoku Cloud, ADX, and price action all suggest ongoing challenges as SOL fails to reclaim key resistance levels. However, if buying pressure returns and SOL can break through the $209 level, a path towards $219 and potentially $244 could open up.

Users Debate Scams and Solana’s Meme Coin Usage

Solana has come under scrutiny following the launch of LIBRA, a controversial meme coin promoted by Argentinian president Javier Milei.

The fallout from this potential pump-and-dump scheme has led many users to question specific Solana applications, such as Meteora and Pumpfun. Concerns also linger about whether the blockchain itself has peaked in terms of adoption and price.

Some users, like prominent artist Gino Borri, allege that Solana applications like Jupiter, Pumpfun, and Meteora extract value from users through scams. This raises concerns about how projects operate within the ecosystem.

“Silence from Solana leadership as their community gets scammed multiple times a day during the Jupiter, Meteora, and PumpFun sponsored Rug Pull Olympics,” Gino Borri posted on X (formerly Twitter).

Others, like DefilLama contributor 0xngmi, shared data on the amount of value extracted from meme coin trading on the chain.

“Calculating total extracted from memes on solana. Trading bots & apps: $1.09B; pump.fun: $492M; MEV: $1.5-2B; Trump insiders: $0.5-1B; AMMs: $0-2B; Total: $3.6 to $6.6+B,” 0xngmi wrote.

However, Mert, the CEO of Helius, a Solana infrastructure provider, counters that the high number of scams is a consequence of Solana’s scale rather than an inherent flaw.

He argues that widespread adoption naturally attracts bad actors, similar to what has happened in other major blockchain ecosystems.

“Hopefully this is the last time I talk about this: crypto is rife with speculation -> speculation leads to scams -> Solana scales crypto -> so there are more scams on Solana. All chains with enough activity will have a lot of this as crypto gets bigger and regulations mature — and they’ve all had it historically (ICOs, NFTs, etc.). This is a transitionary phase. The solution is better launch mechanisms, better regulations, and better norms. When you do all those things, it gets better but will never go away as long as there are humans on the other side,” Mert Mumtaz wrote on X.

Solana’s Indicators Still Show Downward Trend

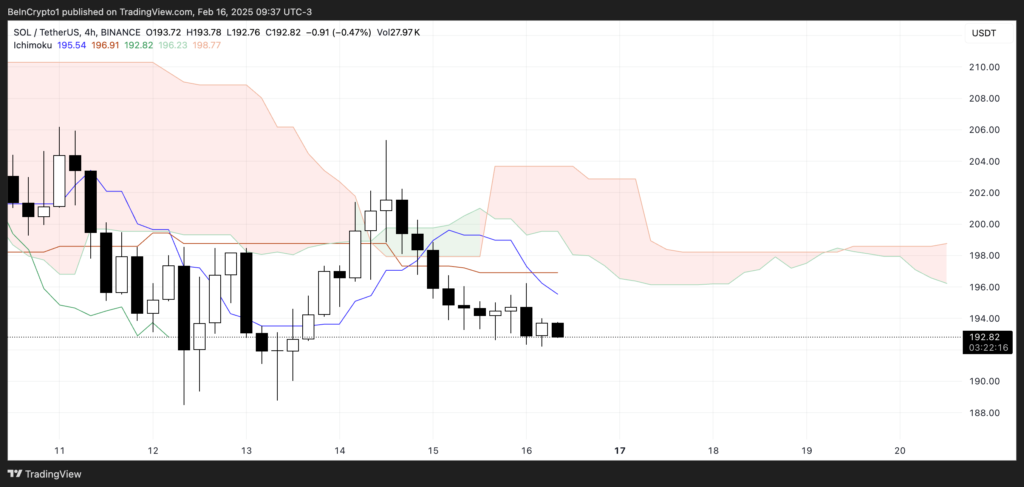

The Ichimoku Cloud chart for Solana shows a bearish outlook, with the price trading below the cloud and key indicators suggesting weak momentum.

The conversion line (blue) is below the base line (brown), indicating short-term weakness. Additionally, the leading span cloud remains red, suggesting continued bearish sentiment.

For SOL’s price to regain bullish momentum, it needs to break through the cloud resistance around the $198 level and sustain a move above $200.

If SOL fails to reclaim these key levels, bearish pressure could continue.

A trend reversal would require SOL to push above both the conversion line and the base line, along with increasing volume to confirm bullish strength. Until then, price action remains under bearish control

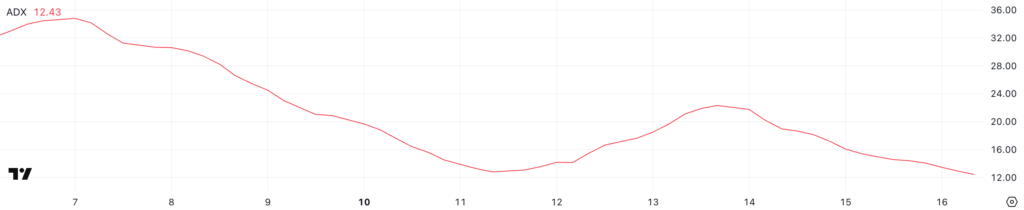

Solana’s Average Directional Index (ADX) currently sits at 12.4, down from 22.3 three days ago. The ADX measures trend strength, with values above 25 indicating a strong trend and below 20 suggesting a weak or non-existent trend.

The decline in ADX signals that Solana’s current downtrend is losing momentum, but has not yet reversed.

The low ADX of 12.4 indicates that the current downtrend lacks strong directional pressure. This could mean that selling pressure is weakening, but it also suggests that the SOL price lacks the strength for a significant reversal.

For a positive shift, the ADX needs to rise above 20 while the price action shows signs of recovery, such as higher highs and higher lows. Until then, SOL remains vulnerable to further declines or sideways movement.

SOL Price Prediction: Will SOL Reclaim $209 Soon?

Solana is struggling to reclaim levels above $205, repeatedly falling below $200 as it fails to overcome that resistance.

If SOL retests the $187 support and fails to hold, it could extend its decline to $175, signaling further weakness.

On the other hand, if the Solana price regains strong momentum like in previous months and enters a clear uptrend, it could push towards the $209 resistance level.

A break above that level would open the door for a rally to $219, and if the bullish strength continues, SOL could even revisit the $244 level.

All information provided on our website is published in good faith and for general information purposes only. Any action you take upon the information found on our website is strictly at your own discretion and risk.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger