In summary

Cardano has increased by 14% this week, with the rising ADX suggesting growing momentum, although the uptrend is not yet confirmed.

Whale activity remains stable, indicating that large investors are not actively accumulating, keeping ADA in a consolidation phase.

ADA could test the $0.90 resistance level and rise to $1.16 if the bullish momentum is sustained, but failure could lead to a decline to $0.50.

Promo

Trade on BYDFi for a chance to win an iPhone 16, Rolex watch, and more!

Cardano’s (ADA) price is showing signs of recovery, up over 4% in the last 24 hours and more than 15% over the week, as it attempts to bounce back from a 24% decline over the past 30 days. Its market capitalization currently stands at $29 billion, while its trading volume has surged by over 100% in the last day, reaching $895 million.

Despite this recovery, whale activity remains stable, suggesting that large investors have not yet accumulated aggressively. If ADA sustains its upward momentum and forms a golden cross, it could push the price towards the $1.16 level, but failure to hold support could trigger another downturn.

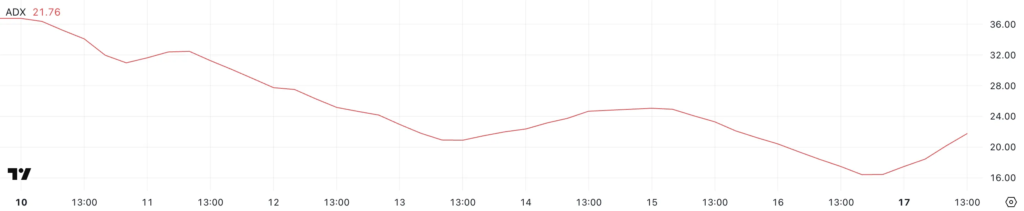

ADA’s ADX Suggests Trend May Be Shifting

Cardano’s ADX has risen to 21.7 from 16.2 in just one day, signaling a strengthening trend.

The ADX (Average Directional Index) measures trend strength on a scale of 0 to 100, with values below 20 indicating a weak trend and above 25 suggesting a strong trend. As ADA’s ADX has crossed above 20, this suggests growing momentum, although it is not yet a fully confirmed trend.

This increase in ADX suggests that ADA is attempting to transition from a downtrend to an uptrend. While a trend reversal is not yet confirmed, if the ADX continues to rise above 25, this will signal stronger bullish momentum.

If buying pressure increases, the ADA price could establish an uptrend, but if the momentum weakens, it may struggle to maintain the recovery.

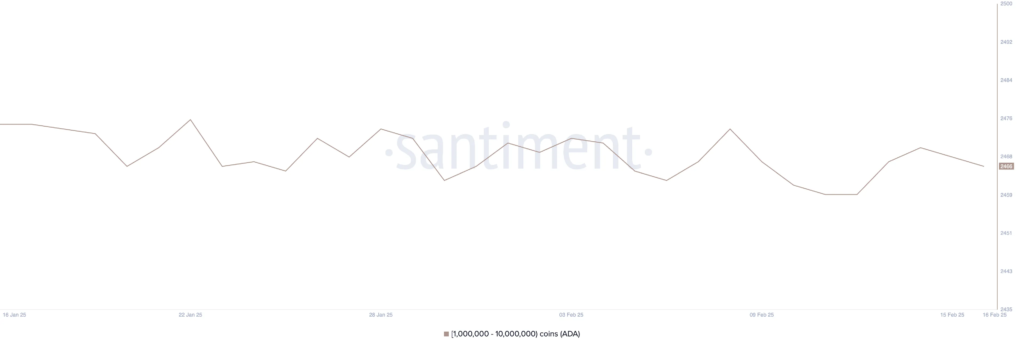

Cardano Whales Remain Unconvinced

The number of Cardano whales – addresses holding between 1 million and 10 million ADA – currently stands at 2,466 and has remained stable in recent weeks.

Monitoring these large investors is important because whales can influence price movements through large buy or sell actions. Increased whale activity often signals periods of accumulation or distribution, affecting market sentiment and liquidity.

The stability in the number of ADA whales suggests that large investors are not buying or selling aggressively. This could mean that ADA is in a consolidation phase, where price movements remain stable until new catalysts emerge.

If whales start accumulating, this could signal confidence in a potential uptrend, while a decline in whale holdings could indicate increasing selling pressure.

ADA Price Prediction: Can ADA Reclaim $1 in February?

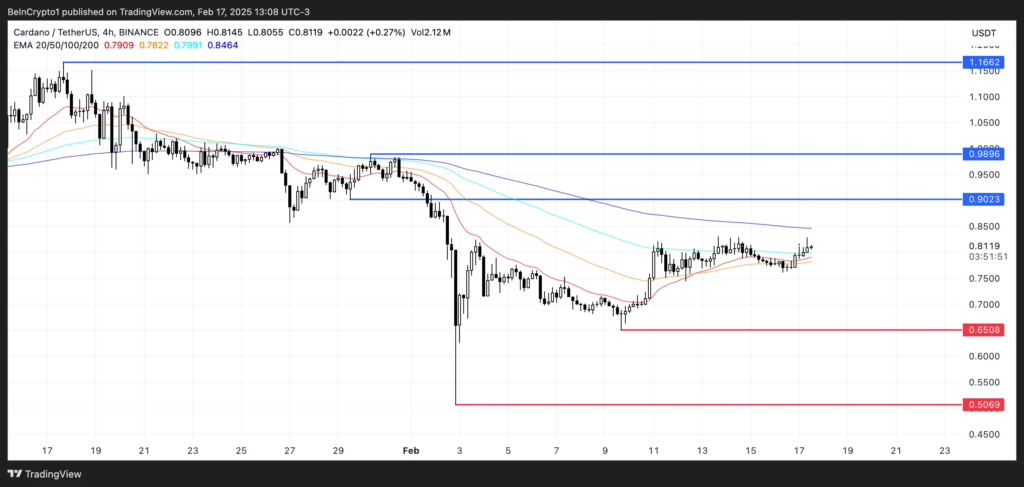

ADA’s EMAs show short-term moving averages trending upward, signaling potential bullish momentum. If a golden cross forms, the Cardano price could continue its rise to test the resistance level at $0.90.

A breakout above this level could push the price to $0.98, and if the momentum strengthens, the ADA price could reach $1.16, trading above $1 for the first time since mid-January.

On the flip side, if the bullish trend fails to gain strength, the ADA price could retest the support level at $0.65.

Losing this level could lead to a deeper drop to $0.50, marking a potential 37% correction.

All information on our website is published in good faith and for general information purposes only. Any action you take upon the information found on our website is strictly at your own discretion and risk.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger