In Summary

Hedera (HBAR) saw $17 million in outflows, reflecting weak demand and increased selling pressure in the spot market.

Market sentiment remains negative, with a negative weighted sentiment index indicating a lack of confidence among traders.

HBAR is at risk of falling below $0.20, with a potential drop to $0.17, unless demand picks up to push it towards $0.26.

Promo:

Trade on BYDFi and get a chance to win prizes like an iPhone 16, a Rolex watch, and more!

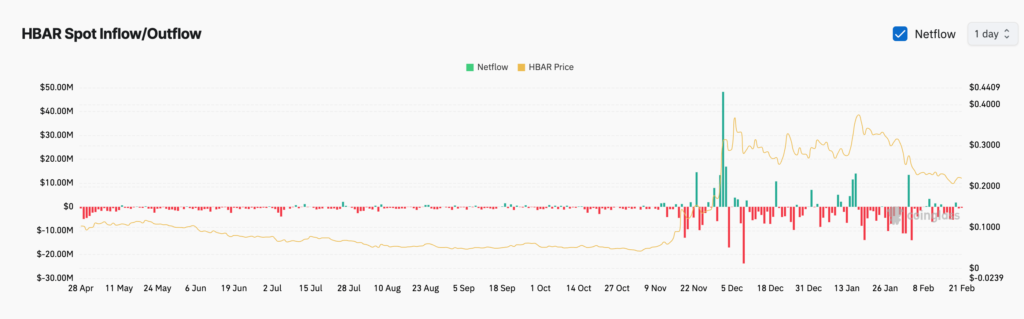

Over the past week, Hedera has recorded consistent outflows from the spot market, indicating a lack of confidence from market participants.

Increased selling pressure highlights the weakening demand for the altcoin, raising concerns about its ability to maintain above the crucial $0.20 support level.

Hedera Outflows Signal Weak Demand

The past week has seen significant outflows from the HBAR spot market, with investors withdrawing over $17 million in the last seven days. According to data from Coinglass, the altcoin only experienced one inflow during this period, with $1.78 million recorded on January 19th

Outflows from the spot market occur when investors of an asset withdraw capital from the spot market, often by selling the asset and moving the funds elsewhere. This indicates weakening demand and increased selling pressure, which can push the asset’s price lower.

HBAR’s consistent outflows suggest a bearish market sentiment as traders prefer to exit their positions rather than accumulate more of the asset.

Notably, the token’s negative weighted sentiment confirms the bearish market outlook. According to Santiment, the on-chain metric, which analyzes social media and online platforms to assess the overall sentiment (positive or negative) surrounding a cryptocurrency, has only returned negative values throughout the week. This reflects a lack of optimism from HBAR investors about its future performance.

At the time of writing, the token’s weighted sentiment was -0.61. When the value of this metric is negative, it indicates that the overall market sentiment towards the asset is bearish, with more negative discussions and outlooks outweighing positive ones. This suggests the potential for further price declines as traders are not motivated to open additional trades.

HBAR Bears in Control: Can It Hold Above $0.20?

BeInCrypto’s assessment of HBAR’s performance on the daily chart shows that since reaching a four-year high of $0.40 on January 17th, it has trended below a descending trendline, confirming its price decline. Trading at $0.21 at the time of writing, the token’s value has decreased by 48%

When an asset trades below a descending trendline, it indicates a sustained downtrend, where selling pressure consistently outweighs buying activity. This suggests that HBAR is struggling to push its price above the resistance level, reinforcing the possibility of further price declines. If this difficulty persists, its price could fall below the $0.20 price zone to trade at $0.17.

On the other hand, a resurgence in demand would invalidate this bearish forecast. HBAR’s price could break above the descending trendline and climb to $0.26 if that happens.

All information on our website is published in good faith and for general informational purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk, and they should re-evaluate it

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger