In Summary

Ethereum rebounds after the Bybit hack but remains down 18% over 30 days, reflecting ongoing volatility.

An RSI recovery to 58.6 suggests renewed buying pressure, signaling potential for further gains. Increased whale accumulation indicates growing institutional confidence, supporting a bullish outlook.

Promo:

Trade on BYDFi and get a chance to win prizes like an iPhone 16, a Rolex watch, and more!

Ethereum (ETH) has shown signs of recovery after a sharp decline due to the Bybit hack, which impacted its price. Despite the recovery, ETH is still down nearly 18% over the past 30 days, reflecting ongoing volatility.

Notably, ETH’s RSI has rebounded to 58.6 from a low of 39.2 during the sell-off, indicating that buying pressure has returned. This recovery in the RSI suggests that market sentiment is gradually improving, potentially paving the way for further price increases if momentum continues.

ETH’s RSI Recovers From Recent Dip

ETH’s RSI is currently at 58.6, a significant increase from the 39.2 it reached after the Bybit hack significantly impacted its price.

The recovery in the RSI reflects that ETH’s buying momentum has increased since the sharp decline.

This rise in the RSI indicates that buying pressure has returned, helping to stabilize Ethereum’s price and potentially paving the way for further price increases if momentum continues.

The RSI, or Relative Strength Index, is a momentum indicator that measures the speed and change of price movements. It oscillates between 0 and 100, with thresholds at 30 and 70

An RSI below 30 is typically considered oversold, suggesting a potential buying opportunity, while an RSI above 70 is considered overbought, signaling a possible price correction.

ETH’s current RSI of 58.6 is in the neutral zone but leans towards bullish momentum. This level suggests that Ethereum still has room to grow before reaching overbought territory, potentially leading to sustained price increases as buying interest remains steady.

Ethereum Whales Accumulate After Bybit Hack

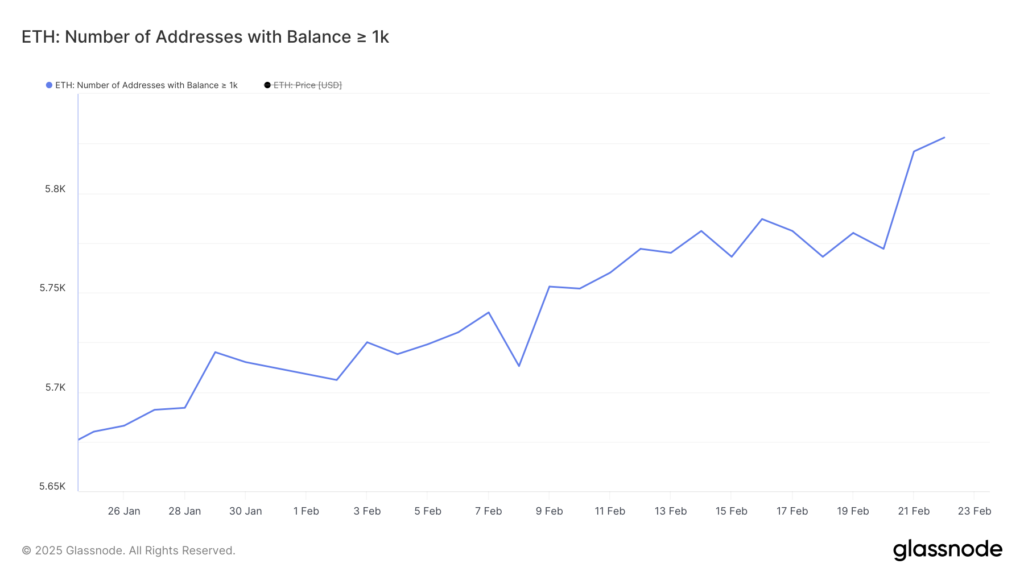

The number of Ethereum whales – addresses holding at least 1,000 ETH – has steadily increased over the past month, rising from 5,680 on January 25, 2025, to 5,828 on February 22, 2025.

This is the highest level since December 2023, indicating renewed interest and accumulation from large investors. The increase in whale addresses suggests that institutional investors or high-net-worth individuals are building positions, possibly anticipating future price increases, especially between February 21, 2025 and February 22, 2025, when ETH’s price dipped following the Bybit hack.

This growing accumulation could provide a solid foundation for ETH’s price to rise.

Tracking Ethereum whales is crucial because their buying and selling behavior can significantly influence the market.

When whales accumulate, it reduces the circulating supply, potentially driving prices up as demand meets scarcity. Conversely, when they sell, it can create significant downward pressure.

Currently, the increase in whale addresses suggests growing confidence and a bullish sentiment among large investors.

Although this is the highest level since December 2023, it is still relatively low compared to historical data. This suggests there is room for further accumulation. If this trend continues, it could lead to a sustained price increase in ETH as demand outpaces supply.

Can Ethereum Surge Back Above $2,900?

Ethereum’s EMAs indicate that a Golden Cross may be imminent. A Golden Cross typically signals a bullish trend and potential upward momentum.

If this occurs, Ethereum could test the price level near its long-term line (the blue line in the chart) around $2,876. Breaking this resistance could open the door for a move to $3,020.

If the uptrend continues with strong momentum, ETH could reach $3,442

However, ETH has struggled to reclaim levels above $2,900 in recent attempts, signaling potential resistance and market indecision.

If it fails to break through again and a downtrend begins, ETH’s price could test the support level at $2,551. Losing this support could lead to a sharper decline, potentially dropping to $2,159.

All information on our website is published in good faith and for general informational purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk, and they should re-evaluate it.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger