In Summary

HBAR surged 20% after Nasdaq filed for a Grayscale spot HBAR ETF listing, sparking optimism. Despite the rally, bearish market indicators show weakening buying pressure and increasing short order dominance.

HBAR price is at $0.24, with $0.22 as key support; a negative turn could push it down to $0.17.

Promo:

Trade on BYDFi and get a chance to win prizes like an iPhone 16, a Rolex watch, and more!

HBAR recorded a 20% increase during Wednesday’s intraday trading session. This double-digit surge was fueled by Nasdaq filing a 19b-4 form with the U.S. Securities and Exchange Commission (SEC) to list and trade Grayscale’s spot HBAR ETF.

However, the upward momentum appears to be losing steam. Market indicators suggest that bearish sentiment is strengthening, putting HBAR at risk of losing its recent gains.

HBAR Faces Downward Pressure as Market Sentiment Turns Bearish

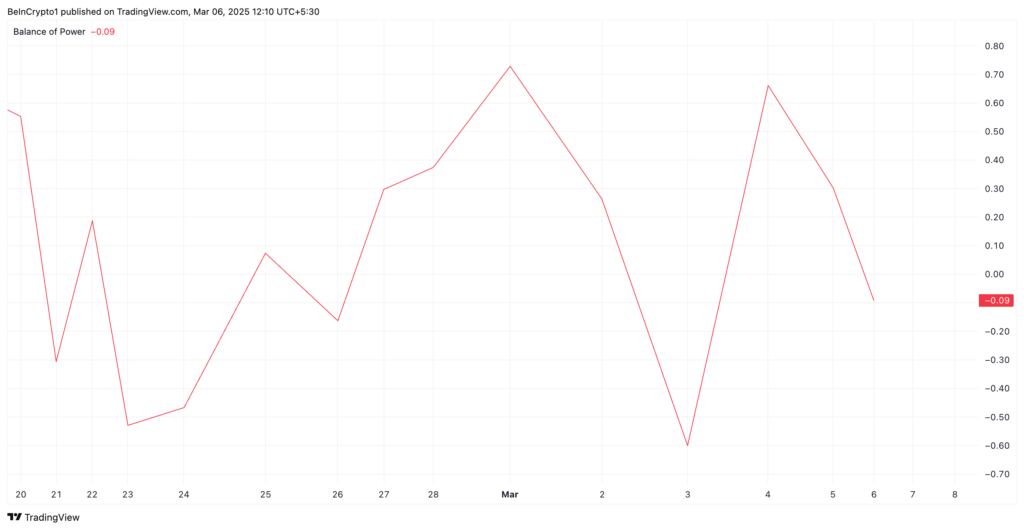

HBAR’s negative Balance of Power (BoP) indicator shows weakening buying pressure among retail investors in the spot market. At the time of writing, this indicator, which compares the strength of buyers and sellers of an asset, is below zero at -0.09.

When an asset’s BoP is negative, sellers have more control over price action. This shows weakening buying pressure in the HBAR market and suggests the potential for continued downward momentum.

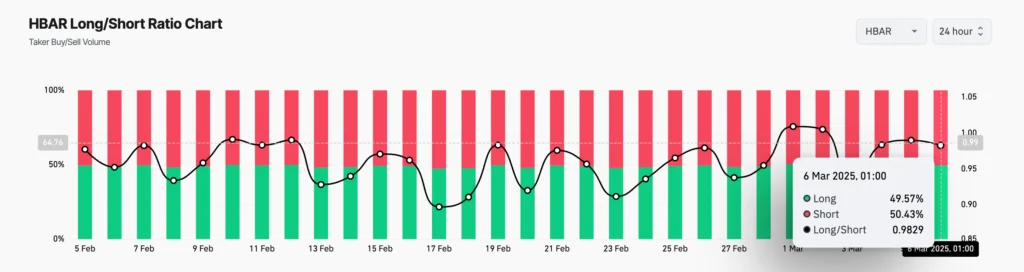

Furthermore, HBAR’s Long/Short Ratio shows an increase in the dominance of short positions, confirming bearish sentiment among its futures traders. At the time of writing, this ratio is 0.98.

The Long/Short Ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price decreases) in the market. When this ratio is below 1, it indicates that there are more short positions than long positions. This highlights bearish sentiment among HBAR investors and increases downward pressure on its price.

HBAR’s Fate Hangs in the Balance

HBAR is trading at $0.24 at the time of writing. On its daily chart, it trades above a support level formed at $0.22. If bearish pressure intensifies, this level may not hold. HBAR’s price could decline further to $0.17 if buyers fail to defend this support level.

Conversely, a positive shift in market sentiment could prevent this. If new demand flows into the market, HBAR’s price could break through the resistance level at $0.26 and rise to $0.31.

All information on our website is published in good faith and for general informational purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk, and they should re-evaluate it.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger