In Summary

IP rose 4% despite a $148 billion market decline, with trading volume up 53% to $159.47 million, indicating strong demand. A short squeeze caused $1 million in liquidations, forcing short sellers to buy back, potentially fueling further price increases.

The Elder-Ray index at 0.46 confirms bullish momentum. If demand persists, it could rise to $6 or fall to $4.36 if it weakens.

Promo:

Trade on BYDFi and get a chance to win prizes like an iPhone 16, a Rolex watch, and more!

Story’s IP has emerged as the top-performing asset in the market over the past 24 hours. It has defied the general market downturn, registering a 4% price increase during that period.

This price surge is fueled by strong demand, evidenced by soaring trading volume and liquidated short positions. With buyers regaining strength, they could propel IP to new highs in the coming days.

IP’s Rally Driven by Demand, But Short Sellers Are Increasing

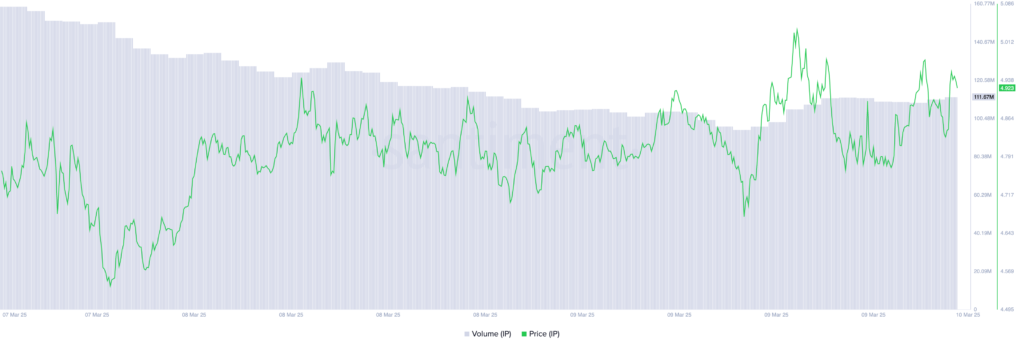

IP’s daily trading volume has surged by 53% in the last 24 hours, reaching $159.47 million. This spike occurred despite a general market downturn that wiped out $148 billion from the total cryptocurrency market capitalization within the same timeframe

A price increase of an asset, accompanied by a surge in trading volume, indicates strong market interest and growing demand. For IP, this trend suggests that its rally is driven by genuine demand, not speculative trading activity.

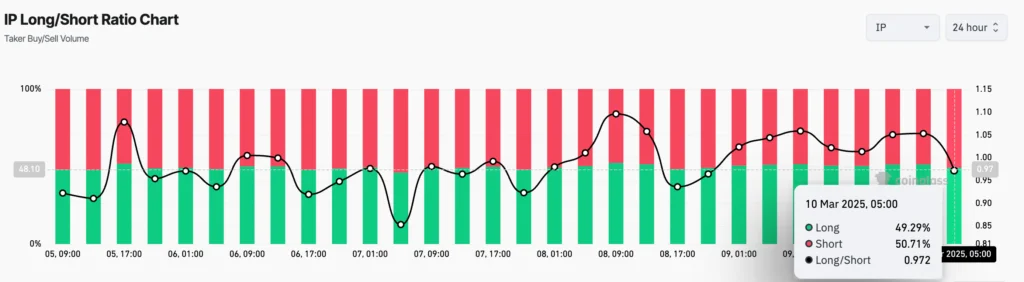

Despite the current bullish momentum, futures market data reveals that IP traders have aggressively opened short positions, as indicated by its long/short ratio. At the time of writing, this ratio is below one, at 0.97.

The long/short ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price decreases) in the market. A higher ratio indicates bullish sentiment, while a lower ratio suggests growing bearish pressure.

For IP, as this ratio falls below 1, it means there are more short positions than long positions, indicating that traders are predominantly betting on a price decline.

However, IP’s price increase has triggered a short squeeze of nearly $1 million in the last 24 hours. This forces short sellers to close their positions, which can push the asset’s price higher in the short term.

IP’s Growth Momentum Remains Solid

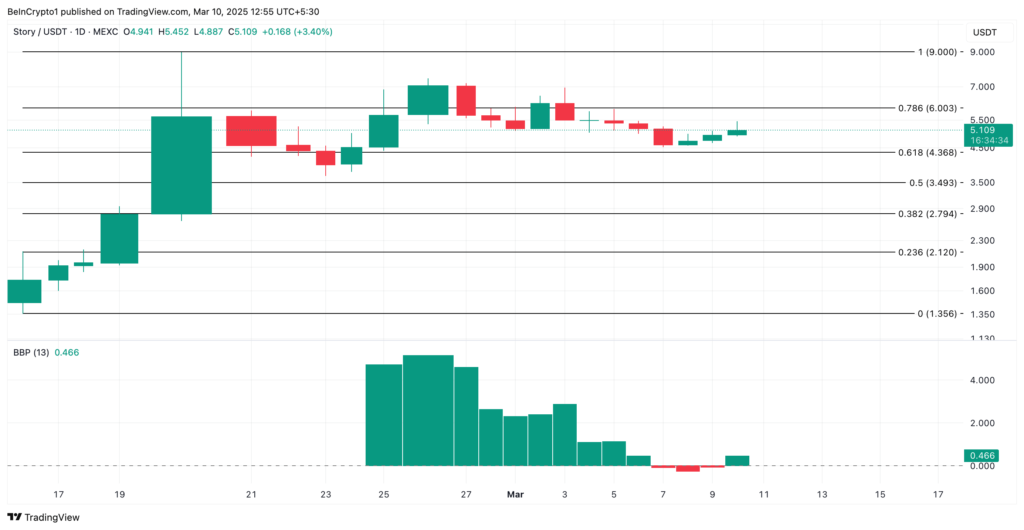

IP’s Elder-Ray index supports the bullish outlook. At the time of writing, this indicator, which measures the strength of buyers and sellers, stands at 0.46

When the indicator’s value is positive, buyers are in control. This trend suggests that IP is currently trading above the value of the bears’ power, signaling bullish momentum. If this continues, the token’s price could rise to $6

Conversely, if demand stagnates, IP’s price could fall to $4.36.

All information on our website is published in good faith and for general informational purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk, and they should re-evaluate it.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger