In Summary

XRP’s supply in profit decreased by 6.39 billion tokens, reflecting increased selling pressure and bearish market sentiment. New demand slowed, with the number of new XRP addresses hitting a yearly low for the day, signaling weaker market interest.

XRP faces key resistance, trading below a descending trendline; failure to break out could lead to a drop below $2.

Promo:

Trade on BYDFi and get a chance to win prizes like an iPhone 16, a Rolex watch, and more!

XRP has maintained a downtrend since reaching its all-time high of $3.40 on January 16th. Currently, it is trading at $2.18, marking a 35% price decrease over the past two months.

This double-digit decline has led to a decrease in the number of XRP tokens held in profit. On-chain data suggests that negative sentiment towards the altcoin is growing, hinting at a prolonged downturn.

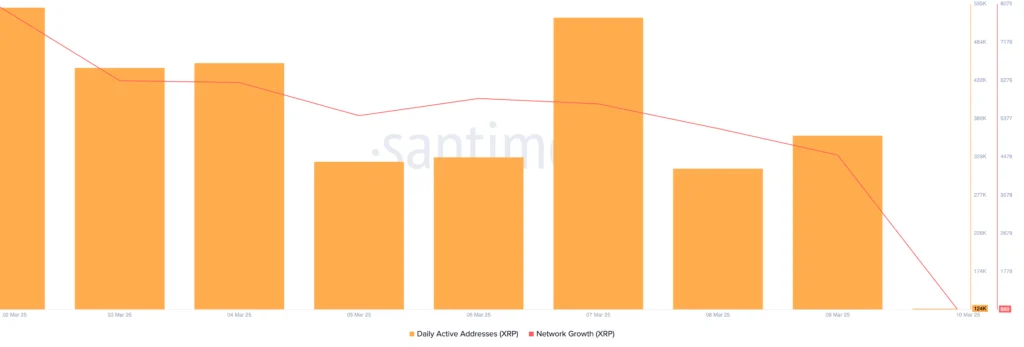

XRP Sees Decline in New Demand, Signaling a Slowdown in Market Interest

As XRP’s price has fallen, its total supply in profit has also decreased. According to Santiment, this has dropped by 6.39 billion in the past week to reach a yearly low. See more here

At the time of writing, 87.95 billion tokens out of the total supply of 99.98 billion are being held in profit. This indicates that some investors are currently holding XRP at a loss, reflecting increased selling pressure and weakened market sentiment. See more here.

Furthermore, on-chain data also shows a decline in new demand, with the daily number of new XRP purchases dropping significantly this month. According to Santiment, only 4,516 new wallet addresses were created on Sunday to transact XRP.

This is the lowest number of new daily demand for XRP since the beginning of the year

When an asset sees a decline in new demand, it means fewer investors are buying it. As observed with XRP, this has reduced trading activity and weakened price support in its spot market. It signals that market interest in the altcoin is waning and could contribute to further price declines if selling pressure remains high.

XRP Faces Selling Pressure: Can Bulls Break the Downtrend?

On the daily chart, XRP has been trading below a descending trendline since reaching its all-time high, reflecting a downtrend.

This bearish pattern is formed when an asset’s price consistently makes lower highs over time. It suggests that sellers are in control, and unless the price breaks above the trendline, further declines are likely

XRP is trading at $2.17 at the time of writing, significantly below this descending trendline. With the growing bearish trend, the token’s price could decline further from this trendline. In that case, XRP’s value could drop below $2 to $1.47.

However, if buying pressure increases, XRP could break above the descending trendline and rise to $2.93.

All information on our website is published in good faith and for general informational purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk, and they should re-evaluate it

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger