In Summary

Alameda withdrew $23 million worth of Solana tokens, but this had little impact on SOL’s price and demand. The unlocked tokens were sent to 38 addresses linked to FTX, which had previously received SOL from Alameda.

These token movements may be related to FTX’s ongoing repayment process.

Promo:

Trade on BYDFi and get a chance to win prizes like an iPhone 16, a Rolex watch, and more!

Alameda Research unlocked nearly $23 million worth of Solana tokens today. While this is a notable event, it has had minimal impact on SOL’s underlying price or demand dynamics.

FTX’s repayment process has begun, and the company has unlocked $1.57 billion worth of SOL. Alameda’s smaller unlock comes amidst strong bearish market factors influencing demand.

How Will Alameda Use Its Unstaked Solana Tokens?

According to on-chain data from Arkham Intelligence, Alameda Research distributed the unstaked SOL to 38 addresses linked to FTX. To recap, Alameda was the trading firm implicated in the collapse of FTX, run by Caroline Ellison.

“An Alameda address just unlocked $23M in SOL to 38 new addresses. An FTX/Alameda staking address received $22.9M in SOL from an unlocking staking address and just distributed it to 37 addresses that had previously received SOL from it. The addresses currently hold $178.82M in SOL,” Arkham stated via social media

Since its collapse, Alameda has moved large amounts of assets on multiple occasions. For example, Alameda’s bankrupt addresses staked $10 million in MATIC tokens in late 2023 and moved $14.75 million worth of Ethereum in early 2024.

However, both of these events caused significant price volatility for the assets involved.

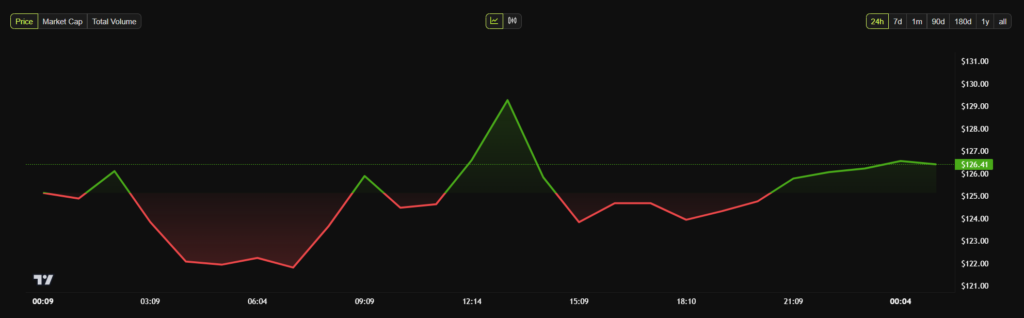

Solana’s price, in contrast, has barely moved since Alameda’s transactions took place. Yesterday, the SEC delayed several Solana ETF applications, and this had a slight bearish impact on the altcoin’s price.

However, ETH rose 10% when Alameda moved a supply worth $14.75 million. Today, they moved even more SOL, but this didn’t even cause the biggest price fluctuation of the day.

Solana has been declining and rising in a short period, but all of this happened before the announcement. In comparison, Alameda’s unlock had virtually no impact.

To date, it remains unclear what Alameda intends to do with these unlocked Solana tokens. Last month, FTX initiated its first round of repayments to creditors, but this will be a long process. Earlier this month, FTX also unlocked $1.57 billion worth of Solana tokens.

In other words, Alameda may be planning to use these tokens as part of FTX’s repayment process, but that may not change Solana’s demand.

The cryptocurrency market is currently in a state of Extreme Fear, and most major assets are seeing large outflows. Alameda’s actions are just a drop in a very large bucket.

All information on our website is published in good faith and for general informational purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk, and they should re-evaluate it

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger