Summary

Over $14 billion in Bitcoin and Ethereum options will expire today, impacting short-term price trends.

Bitcoin options have a notional value of $12.075 billion, with a max pain point at $85,000.

Ethereum options expiring total $2.135 billion, with a max pain point at $2,400 and significantly increased volume compared to last week.

Promo

Trade on BYDFi for a chance to win rewards like an iPhone 16, a Rolex watch, and more!

Today, approximately $14.21 billion worth of Bitcoin (BTC) and Ethereum (ETH) options contracts will expire.

Market observers are paying close attention to this event as it could influence short-term trends through the volume and notional value of these contracts.

$14.21 Billion in Bitcoin and Ethereum Options Set to Expire

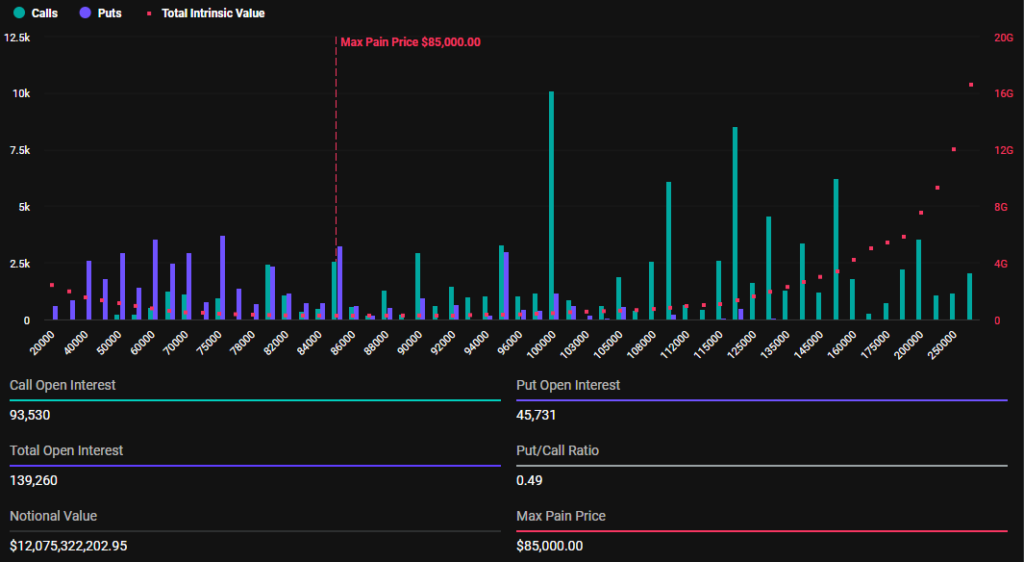

The notional value of BTC options expiring today is $12.075 billion. According to data from Deribit, 139,260 Bitcoin options contracts will expire with a put-to-call ratio of 0.49. This ratio indicates a dominance of call options over put options.

The data also reveals that the max pain point for these expiring options is $85,000. The max pain point is the price level at which the asset would cause the greatest financial losses for investors.

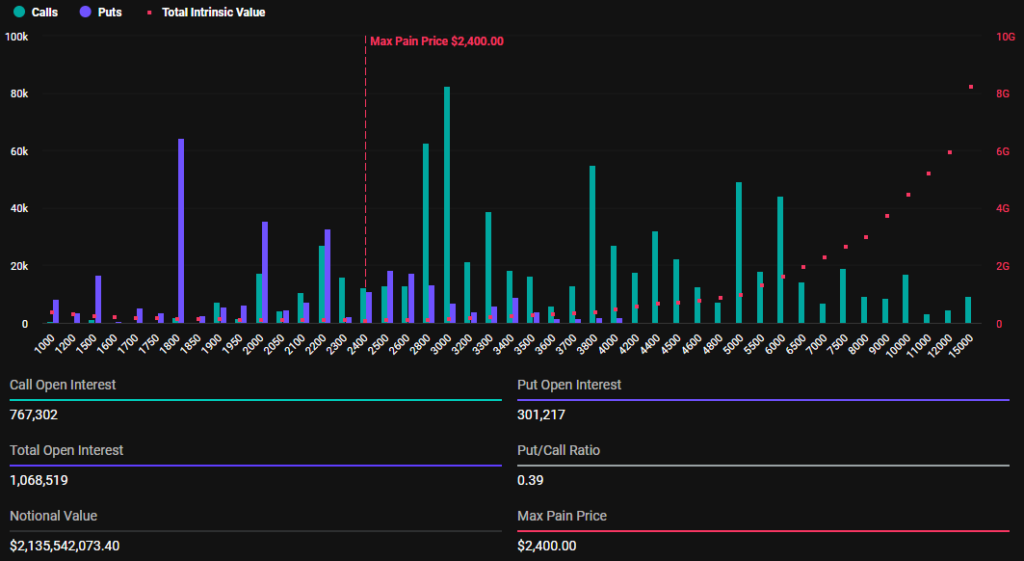

In addition to Bitcoin options, 1,068,519 Ethereum options contracts will also expire today. These expiring options have a notional value of $2.135 billion, a put-to-call ratio of 0.39, and a max pain point of $2,400.

The number of Bitcoin and Ethereum options expiring today is significantly higher than last week. BeInCrypto reported that last week, 21,596 BTC options and 133,447 ETH options expired. Additionally, their notional values were $1.826 billion and $264.46 million, respectively.

This notable difference arises because the options expiring this week are for both the monthly and quarterly cycles, as today marks the last Friday of March.

Deribit options expire on Fridays as it aligns with traditional finance (TradFi) practices and provides a consistent schedule for traders.

In many global markets, including stocks and derivatives, options contracts typically expire at the end of the trading week—usually on a Friday—to standardize timing and facilitate settlement processes.

Deribit has adopted this convention to maintain familiarity for traders transitioning from TradFi to crypto markets and to ensure peak liquidity and market activity at predictable times.

“Tomorrow is not just any regular Friday; it is one of the biggest expiries of the year. Over $14 billion in BTC and ETH options will expire at 08:00 UTC. How do you think Q1 will end?” Deribit posed this question in a Thursday post.

Implied Volatility Ahead of Quarterly Options Expiry

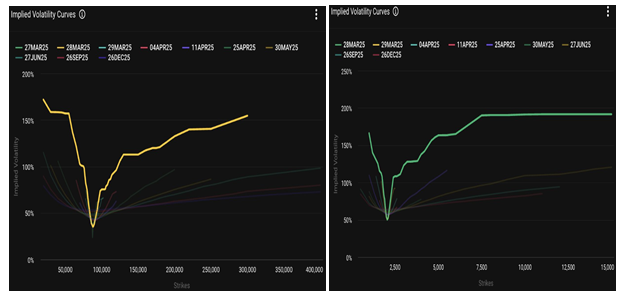

Indeed, today’s options expiry marks the end of the first quarter (Q1) in the options cycle. As this happens, analysts at Deribit, a cryptocurrency derivatives exchange, observe the implied volatility (IV) curves for BTC and ETH, which reflect the market’s expectations for price fluctuations.

Specifically, Bitcoin’s IV curve shows a strong upside skew, meaning call options are priced significantly higher than put options. In contrast, Ethereum’s volatility curve is flatter, indicating less directional bias but still reflecting high volatility. This suggests anticipated price movements around the expiry of $14.21 billion in options.

“Chart 1 – $BTC: BTC shows a strong upside bias, with call options priced significantly higher. Chart 2 – $ETH: ETH’s curve is flatter, but volume remains high across the board. Both markets indicate expectations of movement either at or after expiration,” Deribit noted.

This suggests that both the Bitcoin and Ethereum markets anticipate movement either at or after expiration. Elsewhere, analysts at Greeks.live have shed light on the current market sentiment, citing a prevailing cautious bearish outlook among investors toward Bitcoin.

Specifically, they noted that most traders expect a retest of lower price levels around $84,000–$85,000. At the time of writing, Bitcoin is trading at $85,960, indicating a potential short-term downside.

However, some traders have observed that Bitcoin is trapped in a tight range-bound trading pattern, implying limited volatility unless a breakout occurs. In this context, Greeks.live emphasizes key technical levels.

“The key resistance levels being monitored are 88,400, where there is significant passive selling, and potential support at 77,000, which one trader refers to as a solid bottom,” the analysts wrote.

Greeks.live analysts also observed that implied volatility (IV) is under pressure due to the quarterly settlements, noting a significant deviation in the IV Mark. This suggests opportunities for traders to capitalize on these fluctuations through manual or automated strategies.

All information available on our website is published in good faith and for general informational purposes only. Any actions taken by readers based on the information found on our website should be carefully evaluated, and they assume full responsibility for their own decisions.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger