Summary

The cryptocurrency market is showing signs of revival, and Chainlink is making headlines after reaching its highest price in seven months. This article explores the factors driving this surge, its technical outlook, and what investors should watch for in the coming weeks

🔍 Introduction to Chainlink

Chainlink is a decentralized oracle network designed to bridge the gap between blockchain-based smart contracts and real-world data. It allows smart contracts to securely interact with external APIs, payment systems, and other off-chain resources. Since its launch, The oracle network has become a critical piece of blockchain infrastructure, supporting multiple decentralized finance (DeFi) platforms and Web3 applications.

With its recent price action, Chainlink has captured the attention of both retail and institutional investors — raising the question: Why now?

📊 Market Context: Why Chainlink Is Rising

The recent surge in Chainlink price comes amid broader optimism in the crypto market. Here are the main drivers behind the move:

- Growing Demand for Oracles in DeFi

Decentralized finance applications rely heavily on accurate and secure data feeds. The oracle network technology is considered the gold standard in this sector, giving it a competitive edge. - New Partnerships and Integrations

Over the past months, Chainlink has announced multiple partnerships with blockchain projects, expanding its use cases beyond DeFi into areas like gaming, insurance, and real-world asset tokenization. - Increased Network Activity

On-chain data shows a significant increase in active addresses and transaction volume, suggesting growing adoption and network usage. - Bullish Technical Breakout

Chainlink recently broke a key resistance level, triggering momentum traders and algorithms to join the rally.

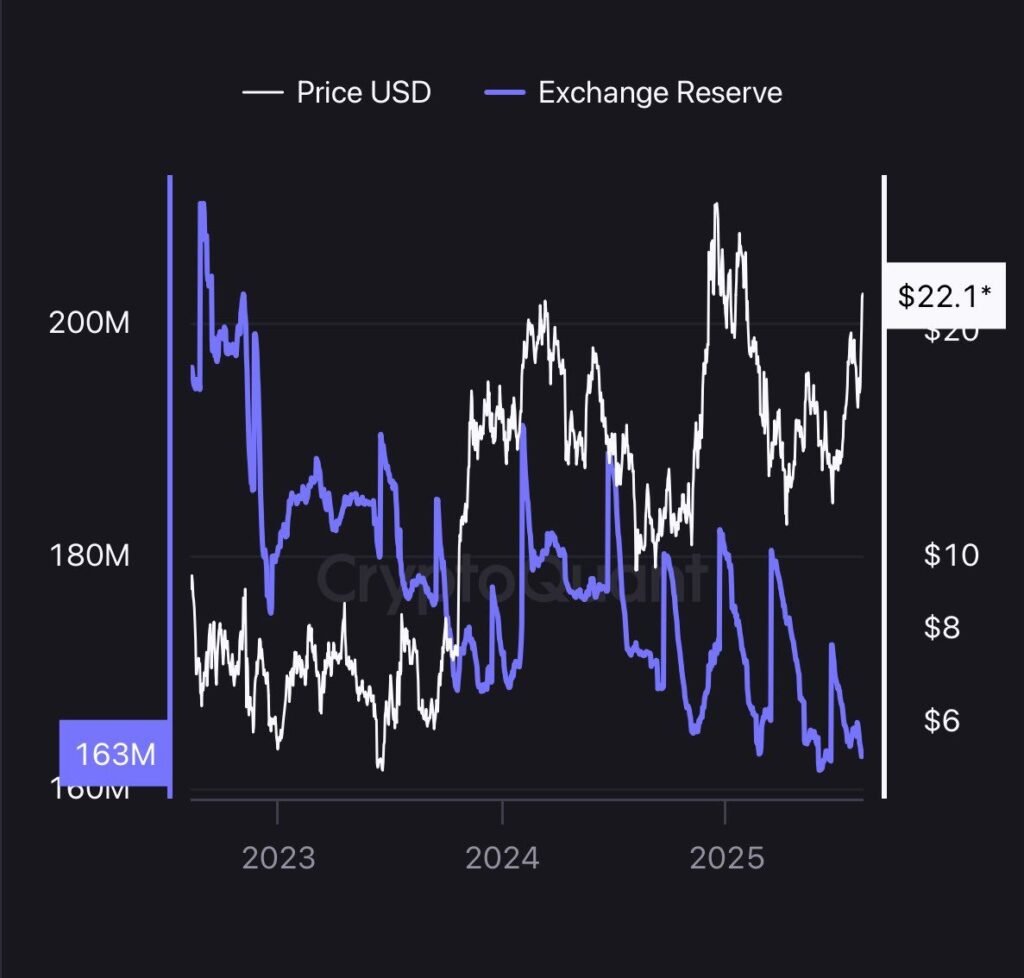

🛠 Technical Analysis: Chainlink’s Price Action

Looking at the charts, Chainlink has been trading within a consolidation range for months. The recent breakout above resistance levels is a strong bullish signal.

- Resistance Level: Around $10.50 — recently broken

- Support Level: Around $8.80 — holding strong for now

- Next Target: $12.00–$13.00 if momentum continues

📉 Indicators to Watch:

- Relative Strength Index (RSI): Currently near overbought territory, suggesting a possible short-term pullback before another leg up.

- Moving Averages (50-day & 200-day): Bullish crossover signals continued upward momentum.

🌐 Chainlink’s Expanding Ecosystem

One of the most exciting aspects of The oracle network is its rapid ecosystem expansion:

- DeFi Integration: Powering major platforms like Aave, Synthetix, and Compound with secure price feeds.

- Cross-Chain Interoperability: The oracle network Cross-Chain Interoperability Protocol (CCIP) is gaining traction, enabling seamless communication between blockchains.

- Real-World Data Feeds: Used for insurance payouts, weather data tracking, and more.

- NFT & Gaming Applications: Providing verifiable randomness (VRF) for fair gameplay and NFT minting.

The breadth of its applications means that Chainlink’s utility is growing alongside the entire blockchain industry.

📅 Key Developments in the Past 7 Months

In the months leading to this price rally, several notable events have fueled The oracle network momentum:

- Launch of New Data Services

Chainlink introduced advanced oracle solutions for financial markets, expanding its revenue streams. - Major Blockchain Partnerships

Collaborations with top layer-1 and layer-2 networks have positioned The oracle network as the go-to oracle provider. - Developer Community Growth

Hackathons, developer grants, and educational programs have increased Chainlink’s developer base, leading to more innovative use cases. - Staking Updates

The rollout of staking features has attracted long-term investors seeking yield while supporting network security.

📈 Investment Outlook for Chainlink

From an investment perspective, Chainlink offers both short-term and long-term opportunities:

- Short-Term: Traders may benefit from volatility around resistance and support zones.

- Long-Term: Growing adoption and integration into real-world applications give The oracle network a strong fundamental foundation.

💡 Risk Factors:

- Market-wide crypto volatility could impact prices.

- Competition from emerging oracle solutions.

- Regulatory developments affecting DeFi infrastructure.

📌 Final Thoughts

The fact that Chainlink has reached a 7-month high is not a coincidence — it’s the result of growing adoption, strong fundamentals, and bullish market sentiment. While short-term pullbacks are possible, the long-term outlook remains promising due to The oracle network central role in powering smart contract innovation.

Investors and traders should keep an eye on technical indicators, ecosystem developments, and broader crypto market trends. If the momentum continues, The oracle network could be poised for further gains in the months ahead.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk