Summary

When the US stock market shows signs of correction, investors often ask: Will Bitcoin be dragged down as well? This article analyzes the stock market crash pattern, its impact on Bitcoin, and strategies to minimize risk.

🔍 1. Stock market crash pattern

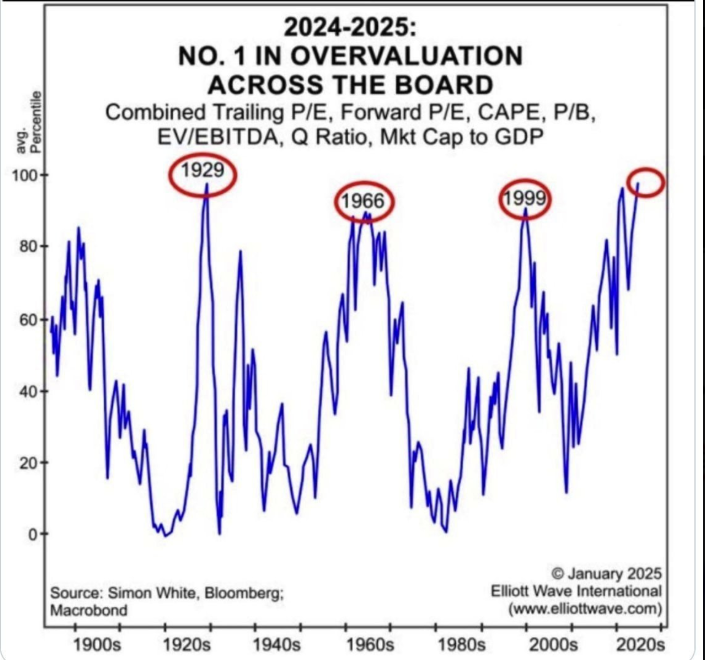

Historically, the US stock market has experienced several major downturns, often aligning with broader economic cycles such as recessions, interest rate hikes, or financial crises. These declines tend to follow certain recognizable patterns that investors watch closely.

One of the most common early warning signs is a persistent drop in major indexes like the S&P 500 and the Nasdaq over several consecutive trading sessions. This often reflects a shift in market sentiment, where optimism gives way to caution or fear. During such periods, investors typically reallocate their capital toward safe-haven assets such as gold, US Treasury bonds, or other low-risk investments.

Another indicator is a sudden spike in trading volume, as large institutional funds and asset managers rebalance their portfolios to reduce exposure to riskier equities. This wave of selling can accelerate downward momentum, deepening the market decline.

Importantly, the effects of a stock market crash often spill over into other asset classes. In recent years, the “risk-off” sentiment has not only impacted equities but also cryptocurrencies like Bitcoin, which tend to decline as investors move away from high-volatility assets in search of stability.

Over time, these patterns have repeated, making them an important focus for traders, analysts, and long-term investors alike when assessing potential market risks.

💰 2. Bitcoin’s correlation with stocks

Although Bitcoin is often referred to as “digital gold” and promoted as a potential hedge against inflation, historical data over the past five years paints a more complex picture. In theory, an asset like Bitcoin should move independently of traditional markets, offering investors a safe haven during economic turbulence. However, real-world performance shows that the story isn’t quite that simple.

When global stock markets experience sharp declines — such as during periods of financial crises, pandemic-induced panic, or major geopolitical tensions — Bitcoin has often followed suit, dropping significantly alongside equities. This trend is especially evident during large-scale sell-offs, where risk assets across the board are liquidated by investors seeking cash or safer assets.

Research also reveals that Bitcoin’s correlation with major indices like the S&P 500 tends to rise notably during times of heightened uncertainty. While in calmer periods Bitcoin may exhibit more independent price movements, during market stress it appears to behave much like other risk-on assets.

This suggests that, at least in the short to medium term, Bitcoin’s performance is still closely linked to the broader financial system, and it may not yet serve as a fully reliable hedge against traditional market volatility..

📊 3. Why Bitcoin is affected

Several factors explain this link:

- Overall market sentiment – Fear prompts investors to sell both stocks and Bitcoin.

- Global liquidity – The Federal Reserve’s tightening policies affect both stocks and Bitcoin.

- Institutional funds – Many funds hold both asset classes and may liquidate them simultaneously during downturns.

📈 4. Outlook and scenarios for Bitcoin

Based on technical analysis, Bitcoin is hovering around a key support level. Two main scenarios:

- Bullish: Bitcoin holds support and rallies thanks to ETF inflows and long-term investors.

- Bearish: A deeper stock market decline drags Bitcoin below support, triggering further corrections.

🛡 5. Strategies for Bitcoin investors

To reduce risk during volatile markets:

- Diversify your portfolio – Avoid putting all capital in Bitcoin or stocks.

- Use stop-loss orders to protect gains.

- Monitor US economic indicators and Fed policy decisions.

- Invest only spare capital and avoid excessive leverage.

📌 Conclusion

Bitcoin remains a promising long-term asset, but in the short term, it is still influenced by US stock market movements. Investors should apply sound risk management and keep a close watch on global economic trends.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk