Summary

In the evolving world of cryptocurrency trading, Crypto Prop (proprietary) firms are reshaping how skilled traders access capital. Rather than risking their own savings, traders can prove their abilities through structured evaluations and gain access to firm-backed trading accounts. Let’s dive into what makes Crypto Prop trading unique, how evaluations work, and why it’s gaining popularity.

1. Understanding Crypto Prop Firms

A Crypto Prop firm provides trading capital to capable traders, allowing them to operate under funded accounts. Instead of deploying their own equity, traders accept a profit-sharing model where they keep the majority of earnings—often between 70% and 90%, with the firm taking the rest.

These firms don’t manage investor funds; they offer a performance-based model. If you demonstrate consistent, disciplined results, you gain access to real capital—sometimes scaling to hundreds of thousands or even millions of dollars.

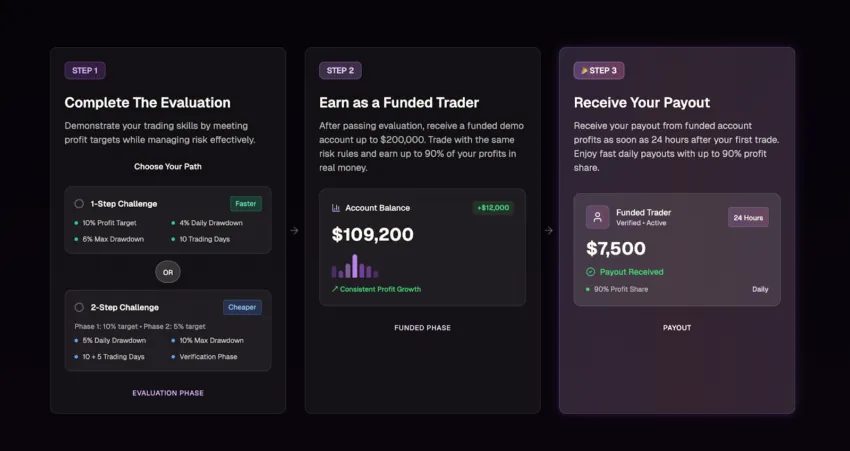

2. How the Evaluation Process Works

To qualify, traders must pass an evaluation that tests both profitability and discipline. Here’s how it typically works:

Stage One – The Challenge

- Achieve a profit target (commonly 8–15%).

- Maintain discipline with strict risk management rules—daily loss limits (e.g., 3–5%) and overall drawdown caps (often 6–12%).

- Some programs enforce a minimum trading period to prevent rushed trading.

Failing any rules or targets means starting over—so discipline is essential.

Stage Two – Verification (if applicable)

Certain firms add a second layer to confirm consistency. You replicate performance over a new time frame while still respecting the same risk limits. Passing both stages earns you a funded account.

Some firms even offer instant funding, removing the second phase to speed up access for experienced traders.

3. Why Crypto Prop Trading Appeals to Traders

- Leverage and capital scaling: Trade larger positions than personal bankrolls allow—without risking your savings.

- Attractive profit splits: Traders often start with high percentages (70–90%) that can scale further with performance.

- Skill-based rewards: This model rewards consistency and risk control over mere luck.

- Structured evaluation: Challenges filter out reckless traders, ensuring only disciplined execution gains access.

4. What It Takes to Pass a Crypto Prop Evaluation

Passing rates are notoriously low—experts estimate only 5–10% of traders succeed. To increase your odds:

- Use strict risk control—many successful traders risk under 1% per trade.

- Focus on highly liquid pairs like BTC/USDT or ETH/USDT to reduce slippage.

- Avoid major news volatility—these periods spike risk unpredictably.

- Maintain emotional composure through both wins and losses. Discipline matters more than raw gains.

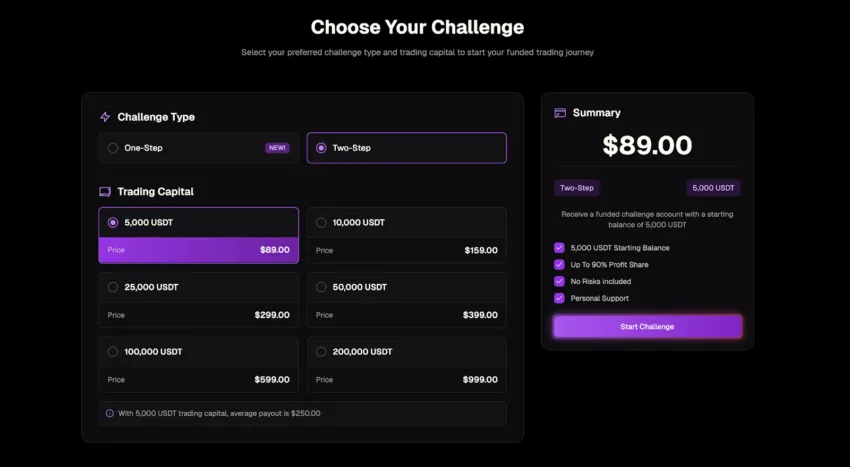

5. What to Assess When Choosing a Crypto Prop Firm

Selecting the right Crypto Prop firm means more than just quick funding:

- Profit split and scaling potential: Higher payout structures and growth opportunities help long-term profits.

- Platform reliability: Look for low-latency and intuitive platforms—especially during fast-moving crypto events.

- Risk rules transparency: Make sure the rules are sensible and clearly documented to avoid surprises.

- Support and training: Firms offering education, mentorship, or active communities can greatly expedite success.

- Reputation and trust: Avoid firms with hidden fees or opaque processes. Clean track records matter.

6. The Pros and Cons of Crypto Prop Trading

Advantages

- Access sizable trading capital without upfront risks.

- Keep most of your gains.

- Opportunity to scale your account and income.

Risks & Challenges

- Low success rate means many will fail the evaluation.

- Loss of control: breaking a rule can lead to disqualification.

- Profit sharing reduces per-dollar returns.

- Psychological pressure from trading firm-owned capital can be intense.

7. Final Thoughts: Is Crypto Prop Right for You?

Crypto Prop trading opens powerful doors for disciplined, skilled traders who lack significant capital. It’s not for everyone—but for those with solid strategy, emotional control, and risk management, it can be a transformative path.

If you’re curious about getting started or want a comparison of leading crypto prop firms today, I’d be happy to help craft an SEO title, meta description, or custom URL to support your content. Just say the word!

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk