Summary

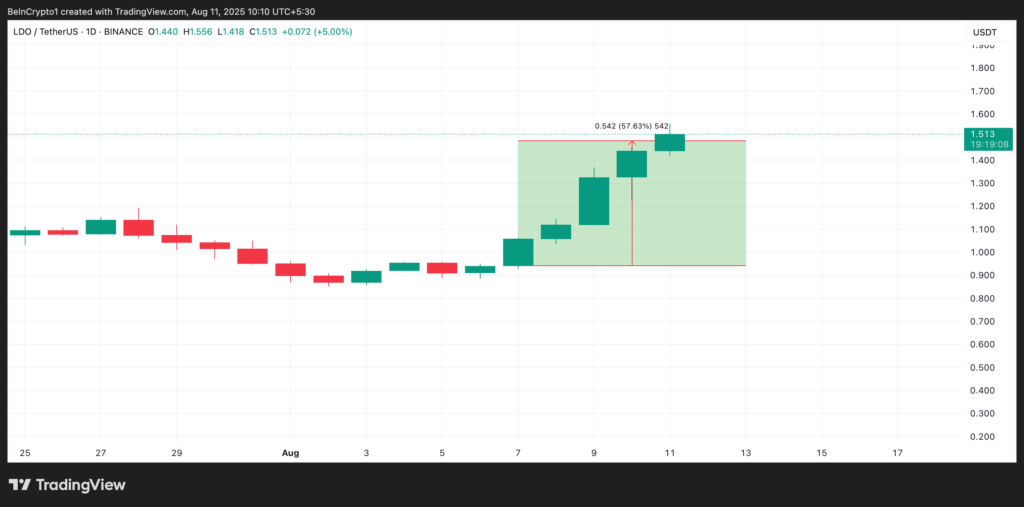

Lido, the leading liquid staking protocol in the cryptocurrency ecosystem, has recently surged to its highest price point in the last six months. This notable rally comes at a time when market sentiment toward Ethereum and staking protocols is turning increasingly positive. Several factors are driving this momentum, including the growing interest in Ethereum staking following network upgrades, ongoing technical improvements from Lido’s development team, and a renewed focus from institutional investors seeking yield opportunities in decentralized finance (DeFi).

Lido 101: What You Need to Know

Lido is a decentralized staking protocol that allows users to stake assets like Ethereum and receive liquid tokens (e.g., stETH) representing their staked positions. These liquid tokens are tradable and can earn staking rewards—bridging the gap between staking and liquidity.

By simplifying staking and offering capital flexibility, Lido has captured a large share of the liquid staking market and become a key DeFi infrastructure player.

Why Is Lido Surging Now?

A confluence of factors has driven Lido’s strong performance:

- Renewed Ethereum Activity 🔥

With growing interest in Ethereum upgrades and staking, demand for Lido’s staking solution has intensified. - Platform Enhancements & Ecosystem Expansion 🛠

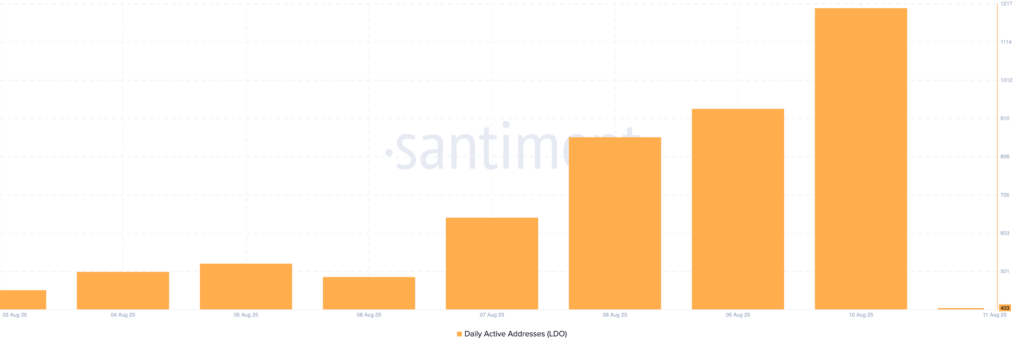

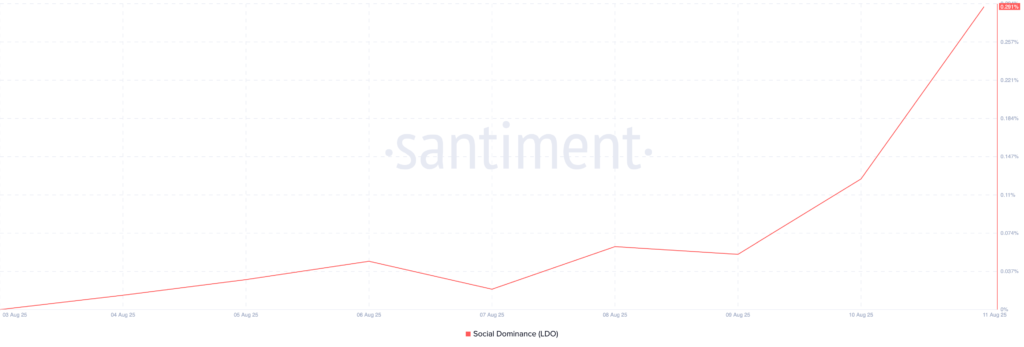

Recent updates to smart contracts and staking mechanisms have improved Lido’s security and efficiency, attracting more users. - Institutional and On-Chain Interest 👥

Large-value stakeholders have increased their exposure to Lido, indicating confidence in long-term staking returns and protocol stability.

Technical Snapshot: Lido at a Glance

| Metric | Current Status | What It Means |

|---|---|---|

| 6-Month High | Achieved | Positive momentum confirmed |

| Support Zone | ~$2.5 | Potential buying area during dips |

| Resistance Levels | ~$3.0–$3.2 | Key breakout zone to watch |

| RSI Indicator | Rising toward overbought | Potential short-term pullback risk |

| Volume | Increasing | Strong conviction behind move |

The technical setup suggests Lido is enjoying a healthy rally. However, if RSI reaches extreme overbought levels, cautious traders might prioritize scaling in rather than jumping in all at once.

What’s Powering Lido’s Ecosystem Growth

- Broadening Liquid Staking Use Cases

Lido’s tokens are now accepted in lending, yield farming, and synthesis protocols—enhancing staked asset utility. - Cross-Chain Integration

Expansion into networks like Terra and Solana has extended Lido’s reach beyond Ethereum, boosting user adoption. - Developer Momentum

Hackathons, DeFi grants, and community-driven development have accelerated innovative use cases involving Lido’s ecosystem.

Risks to Monitor

While Lido’s outlook is promising, some risk factors remain:

- ETH Price Volatility

A drop in Ethereum’s value can impact Lido’s token value and staking dynamics. - Smart Contract Vulnerabilities

While enhancements help, any breach in protocol code could erode trust. - Regulatory Uncertainty

Evolving global regulations around staking services could affect Lido’s operation or access in certain markets.

Smart Strategies for Investors

- Layer Your Entries

Buy near confirmed support levels instead of trying to catch peaks. - Watch ETH Correlation

Since Lido is tied to Ethereum, price swings in ETH may influence Lido’s moves. - Track On-Chain Signals

Large stakings or increased DAO activity may signal bullish continuation. - Stay Informed on Upgrades

Monitor any smart contract upgrades or cross-chain expansions, as they can shift sentiment quickly.

Final Thoughts

Lido’s rise to a six-month high underscores its expanding influence within the staking ecosystem. This growth is fueled by a combination of strong technical performance, steady development momentum, and increasing user adoption across the DeFi landscape. As Ethereum staking continues to gain traction—driven by both individual investors and institutional players—Lido’s liquid staking model offers a unique advantage, allowing participants to earn staking rewards while retaining asset liquidity through stETH.

Market analysts note that while short-term fluctuations or a temporary pullback are always possible, the protocol’s fundamentals remain robust. Lido’s team continues to roll out upgrades aimed at improving efficiency, security, and scalability, positioning it to capture further market share as demand for decentralized yield solutions grows.

From a long-term perspective, Lido is emerging as more than just a staking platform—it’s becoming a key infrastructure layer in DeFi. Its ability to bridge liquidity and staking positions it well to thrive even in a competitive environment.

That said, smart investing requires balancing optimism with caution. Staying informed on market developments, actively managing risk, and aligning investment strategies with broader market trends will remain essential for those looking to capitalize on Lido’s momentum without overexposing themselves to volatility.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk