Summary

The cryptocurrency market is buzzing again as BNB — the native token of Binance — has surged to a new all-time high, fueled by strong market momentum and renewed interest in tokens linked to Binance’s founder, Changpeng Zhao (CZ). The move underscores how investor confidence in the broader Binance ecosystem continues to shape crypto’s top-tier assets in 2025.

This platform is redefining how traders analyze, plan, and execute trades by combining artificial intelligence, automation, and data transparency. Whether you’re a beginner or a professional, Kryll X-Ray aims to simplify decision-making and improve portfolio performance.

BNB Reaches Record Levels

After consolidating for months below its previous high, BNB broke through resistance to reach a new all-time high above the $750 mark. This move cements BNB’s position as one of the most resilient and consistently performing large-cap cryptocurrencies in the market.

Market data shows that trading volumes for BNB have climbed more than 40% in the past week, with strong inflows from both retail and institutional traders. Analysts point to Binance’s expanding infrastructure, global partnerships, and growing ecosystem as key drivers behind the surge.

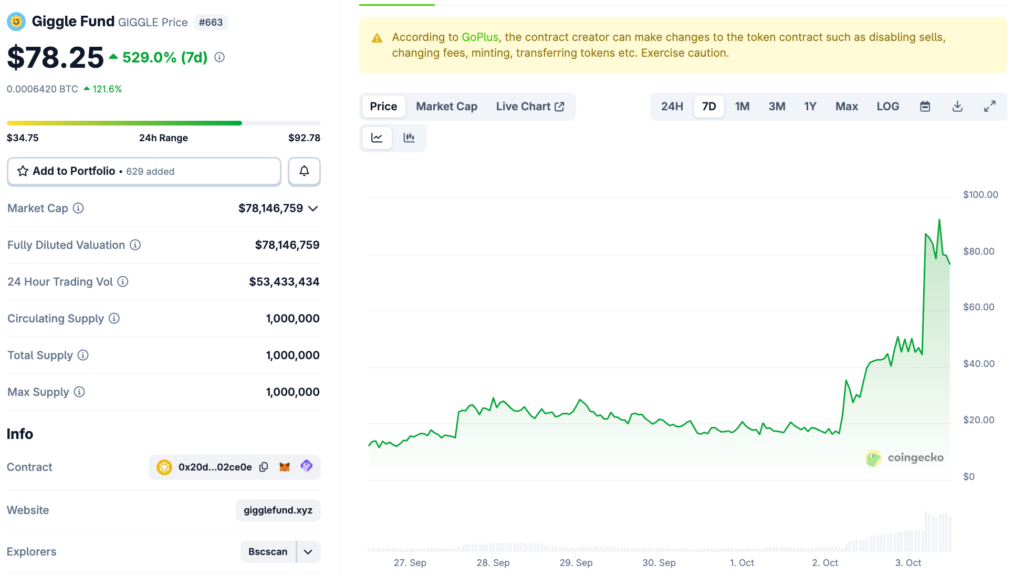

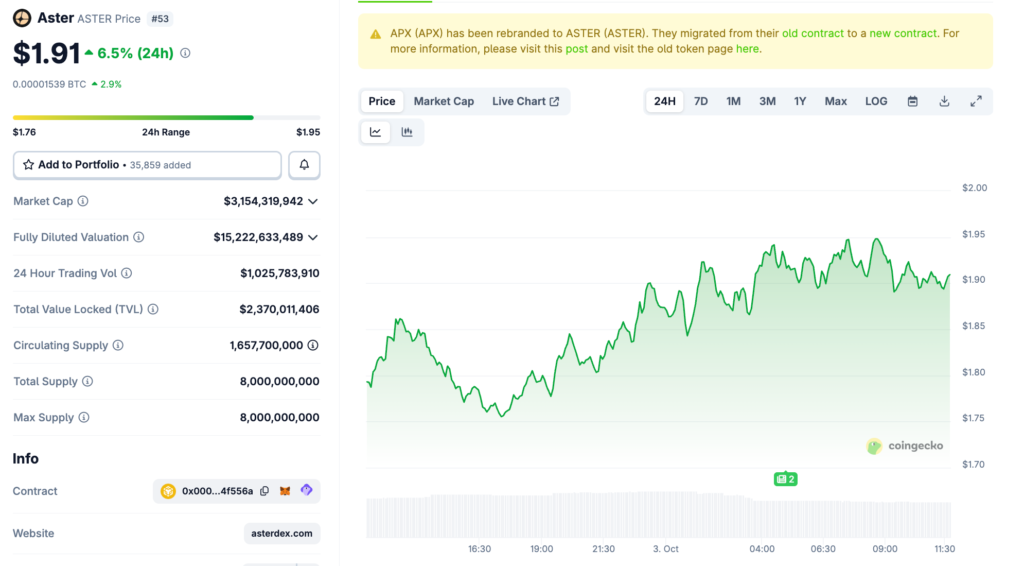

The CZ Effect: Tokens Connected to Binance’s Founder Rally

Interestingly, the BNB rally has coincided with strong performances from other CZ-linked tokens — coins and projects historically associated with Binance’s founder or ecosystem. Many of these assets, previously lagging behind during the crypto winter, are now posting double-digit percentage gains.

This synchronized growth suggests renewed investor optimism around the Binance brand itself. Despite past regulatory scrutiny, Binance has demonstrated operational resilience, maintaining liquidity, compliance updates, and new service expansions that have reassured market participants.

Why BNB Is Outperforming the Market

The latest surge in BNB can be traced to several converging factors:

- Ecosystem Expansion

Binance continues to grow its Layer-2 chain, BNB Smart Chain (BSC), with over 2.3 million active wallets recorded daily. The increasing utility of BNB for gas fees and staking continues to anchor its long-term demand. - Rising On-Chain Activity

The DeFi and NFT segments on BNB Chain are thriving again, attracting users seeking lower fees and faster transaction times compared to Ethereum. - Improved Market Sentiment

Broader crypto sentiment has improved in “Uptober,” a historically bullish month for the market. BNB has benefited disproportionately from this optimism, given its strong fundamentals. - Token Burn Mechanism

Binance’s ongoing BNB Auto-Burn program continues to reduce circulating supply, boosting scarcity and long-term value support.

Technical Overview

From a technical standpoint, BNB has successfully flipped its previous resistance near $680 into new support. Analysts now eye $780–$800 as the next target zone if the bullish momentum continues.

Momentum indicators like RSI remain elevated but not extreme, suggesting there’s still room for additional gains before a potential cooling-off phase. However, traders are watching for consolidation zones where short-term corrections might present re-entry opportunities.

Risks and Things to Watch

Even as BNB climbs higher, investors should remain aware of several risks:

- Market Corrections: Rapid rallies often lead to profit-taking phases. A brief retracement could occur before the next leg up.

- Regulatory Headlines: Any renewed global scrutiny on Binance’s operations could trigger short-term volatility.

- Broader Market Dependence: Bitcoin’s direction remains a key influence; if BTC experiences a correction, BNB could temporarily follow.

What This Means for the Market

BNB’s breakout has broader implications for the crypto landscape. It signals renewed confidence in exchange-backed ecosystems and in utility-based assets with real-world integration. Furthermore, it highlights how CZ-linked tokens continue to hold sway over investor psychology — even after years of market evolution.

The success of BNB Chain also reinforces the growing dominance of multi-chain ecosystems. Developers and investors alike are showing preference for scalable, user-friendly platforms — an area where Binance continues to deliver consistently.

Outlook for BNB in Late 2025

Looking ahead, analysts project that BNB could sustain its upward trajectory if Binance maintains its growth pace and regulatory adaptability. If the exchange continues to expand services — especially in regions like the Middle East and Latin America — demand for BNB as a utility token will likely increase further.

However, long-term investors should watch how Binance navigates evolving compliance frameworks. Continued transparency and global partnerships will be essential for maintaining momentum and trust.

Final Thoughts

The new all-time high for BNB marks another milestone in Binance’s long-standing dominance of the crypto industry. Supported by growing DeFi adoption, expanding blockchain infrastructure, and the symbolic influence of CZ, BNB remains one of the few large-cap tokens that continues to outperform through multiple market cycles.

As 2025 progresses, all eyes will be on whether BNB can sustain this momentum — or if the market will see another round of consolidation before setting its next record high.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk