Summary

Bitcoin has broken past its previous August peak, reaching a new all-time high above $125,000 in early October. This milestone underscores renewed bullish momentum and strengthens Bitcoin’s dominant position in the crypto landscape as the markets enter a seasonally favorable stretch often dubbed “Uptober.”

Breakout and Momentum Signals

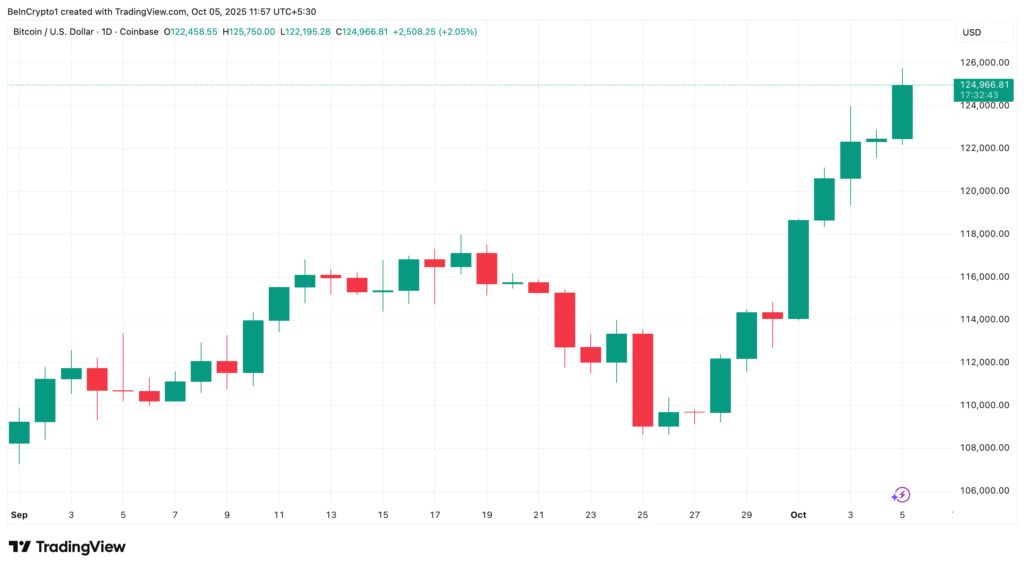

After a volatile September, Bitcoin’s price action gained clarity when it flipped $120,000 from resistance into support. This breakout set the stage for the surge past $125,000, confirming that bulls remain in control. The move reflects a strong shift in sentiment, with major support levels holding steady and enabling further upward momentum.

Throughout October so far, Bitcoin has rallied more than 9%, reinforcing the argument that the current advance is more than just a short squeeze — it may represent a structural trend.

Key Drivers Behind the Rally

Several factors have aligned to fuel Bitcoin’s breakout:

- Institutional Inflows & ETF Activity

Institutional interest continues to layer support beneath price. Spot Bitcoin ETFs and regulated investment vehicles have attracted fresh capital, helping channel mainstream money into crypto. - Macro & Safe-Haven Narrative

With volatility in traditional markets and uncertainty around government spending and monetary policy, many investors treat Bitcoin as a hedge or alternative store of value — especially when trust in fiat systems wavers. - Reduction of Supply on Exchanges

On-chain data indicates a declining supply of Bitcoin held on exchanges, reflecting increased accumulation by long-term holders. Reduced availability for sale intensifies upward pressure when demand surges. - Seasonal Strength (Uptober Effect)

Historically, October has seen strong performance in crypto markets. The current rally is capitalizing on that seasonal window, drawing in momentum traders and reinforcing price structure.

Technical Levels to Watch

- Support zone: $120,000 turned support is critical. If Bitcoin stays above this level, it strengthens the case for continuation.

- Resistance / target zone: Near-term resistance lies around recent high areas and psychological levels — a push past $130,000 could unlock further upside.

- Healthy Correction Zone: If Bitcoin slides, look for possible pullbacks to $118,000–$122,000 as consolidation rather than capitulation.

Traders should monitor volume confirmation, order flow, and momentum indicators for signs of exhaustion or continuation.

Risks & Considerations

While the rally is impressive, participants should keep these risks in mind:

- Overextension

Rapid gains often bring short-term overbought conditions. A correction or consolidation phase is possible, especially if speculative sentiment dominates. - Leverage & Liquidations

High leverage in futures markets can magnify volatility. Even a small reversal could spark cascade liquidations, accelerating downward pressure. - Weak Participation

The rally must eventually be backed by sustained network activity and growing adoption — if volume or user engagement lags, the move may be less stable. - Macro Shocks

Unexpected events (regulations, interest rate changes, geopolitical shocks) can quickly tip sentiment and reverse gains.

What Could Come Next

If Bitcoin maintains supporting trends and sustains institutional inflows, we may see:

- A move toward $130,000+, contingent on momentum and macro conditions.

- Rotations into altcoins and layer-1s as risk appetite broadens.

- Periodic pullbacks to digest gains, offering re-entry opportunities for patient participants.

However, if volatility returns and holders scale for profits, a test of support zones could be in play before another leg upward.

Final Thoughts

Bitcoin’s breakout past $125,000 sets a bold tone for the rest of 2025. The flip of $120,000 into support, rising demand, and structural accumulation suggest this run may have legs — not just heat. But as always in crypto, vigilance and prudent risk management are essential.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk