In summary

Despite strong initial growth, the IBIT Bitcoin ETF faces challenges, particularly Bitcoin’s correlation with stocks, limiting potential adoption.

Institutional interest in IBIT remains robust, with 1,100 holders, but the Bitcoin ETF momentum has slowed down in 2025.

Recent outflows from Bitcoin ETFs and cautious market sentiment may stem from inflation concerns and the Fed’s stance on rate cuts.

promo

Trade on BYDFi and have a chance to win an iPhone 16, Rolex watch…!

Eric Balchunas, a senior ETF analyst at Bloomberg, has suggested that while BlackRock’s iShares Bitcoin Trust ETF (IBIT) has performed well since its launch last year, it faces some challenges going forward.

This assessment comes amid recent signs of turbulence in the broader Bitcoin (BTC) exchange-traded fund market.

Upcoming Challenges for the IBIT Bitcoin ETF

Balchunas points to a key factor that could hinder IBIT’s continued growth: Bitcoin’s tendency to decline when stocks decline. This correlation poses a particular challenge for Bitcoin ETFs, as they may struggle to gain significant adoption compared to more traditional ETFs.

“IBIT hitting $50 billion in its first year (VOO took six years to do that) is definitely notable but it needs a lot more adoption (flows), and you probably need a break in the correlation with stocks,” Balchunas added.

Despite concerns about Bitcoin’s market volatility, recent 13F filings reveal growing interest in IBIT. A 13F filing is a quarterly report required by the U.S. Securities and Exchange Commission (SEC) for institutional investment managers overseeing more than $100 million in assets.

It provides transparency into the investment activities of major investors. All filings must be made public within 45 days of the quarter’s end. Therefore, the deadline for Q4 2024 was February 14, 2025.

Balchunas mentions that IBIT has attracted 1,100 holders through 13F filings. The previous record for an ETF in its first year was around 350 holders.

“For comparison, NUKZ, a fairly successful nuclear theme ETF that launched the same day as IBIT has 29 holders. Most new ETFs have under 10,” he said.

Notably, IBIT remains the largest Bitcoin ETF, holding 2.98% of the total supply. It continues to attract significant investments from major investors, with the latest coming from Abu Dhabi’s Mubadala Sovereign Wealth Fund. Last week, Mubadala invested $436 million in BlackRock’s ETF, becoming its seventh-largest holder.

From a broader perspective, institutional adoption of Bitcoin ETFs has seen remarkable growth. Assets under management tripled in Q4, reaching $38 billion.

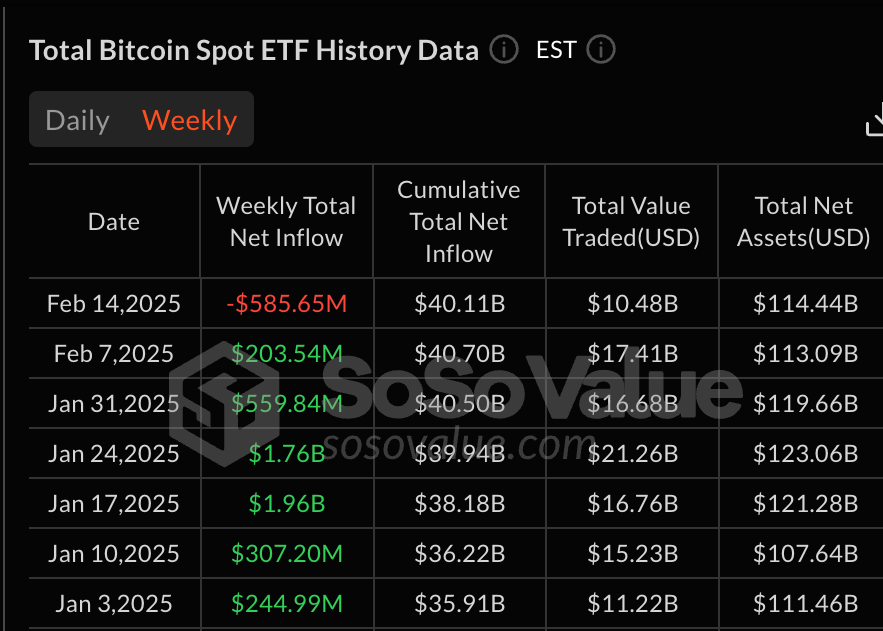

However, recent data suggests the momentum has slowed down in 2025. Bitcoin ETFs saw their first week of net outflows last week. Total weekly net outflows reached over $585 million. Moreover, this trend appears to be continuing.

On February 18th, Bitcoin ETFs experienced $129 million in outflows. As BeInCrypto previously highlighted, this could be due to investor caution following Jerome Powell’s refusal to cut interest rates and ongoing concerns about high inflation.

All information provided on our website is published in good faith and for general information purposes only. Any action readers take upon the information found on our website is strictly at their own discretion and risk.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger