Summary

Cronos surpasses the $0.10 mark after the Trump Media and Crypto.com partnership, triggering a wave of strong bullish technical signals.

RSI drops to 61.2 after peaking at 89.64, indicating that bullish momentum remains intact while still allowing room for sustainable growth.

The alignment of BBTrend and EMA confirms the uptrend, with CRO targeting resistance levels at $0.12, $0.149, and potentially $0.20.

Promo:

Trade on BYDFi for a chance to win exciting rewards like an iPhone 16, Rolex watches, and more!

Cronos (CRO) has seen strong upward momentum in recent weeks following the Trump Media and Crypto.com partnership announcement. This news propelled CRO past the $0.10 mark for the first time since early February, triggering a wave of bullish technical signals.

Indicators such as RSI, BBTrend, and EMA all confirm the strong uptrend, with CRO emerging as the best-performing altcoin in the past 24 hours. As traders focus on key resistance and support levels, the question remains: Can this rally push CRO toward the $0.20 mark?

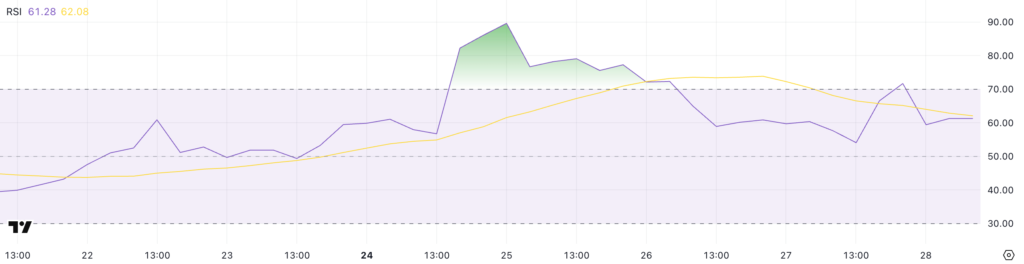

CRO RSI Returns to Neutral After Hitting Multi-Year High

Cronos has gained significant market attention in recent weeks, especially after the Trump Media and Crypto.com partnership announcement.

This surge in interest pushed CRO’s Relative Strength Index (RSI) to a peak of 89.64 just three days ago—its highest level in over a year—signaling intense buying pressure.

Since then, RSI has cooled down to 61.2 as prices slightly corrected following the strong rally. Despite this dip, Cronos remains the top-performing altcoin in the past 24 hours, posting a 7% gain, suggesting that bullish momentum is still in play

RSI (Relative Strength Index) is a momentum indicator used to assess whether an asset is overbought or oversold. It ranges from 0 to 100, with levels above 70 typically indicating overbought conditions and levels below 30 signaling oversold territory.

With CRO’s RSI currently at 61.2, the asset is no longer in overbought territory but still demonstrates strong bullish momentum. This suggests that prices may continue to rise, especially if renewed interest or positive news emerges.

At the same time, the cooldown from extreme RSI levels could be paving the way for a more sustainable rally.

Cronos’ BBTrend Remains Strong but Declines Slightly from Recent Highs

Cronos recently shifted its BBTrend indicator back into positive territory, currently sitting at 25.05—a slight decrease from its recent peak of 26.56, which was reached just yesterday.

This shift follows five consecutive days of negative BBTrend values, signaling a significant change in market momentum.

The shift into positive territory indicates that bullish pressure has returned, aligning with the price increase and overall sentiment surrounding CRO after its surge in prominence and trading activity.

BBTrend, or Bollinger Band Trend, is a momentum indicator used to determine whether an asset is trending upward, downward, or moving sideways.

A positive BBTrend value typically indicates bullish momentum, while a negative value suggests bearish sentiment. The higher the value, the stronger the trend.

With CRO’s BBTrend at 25.05, the asset is exhibiting strong bullish momentum, although the slight decline from yesterday’s peak may signal early signs of cooling off or a short-term correction.

However, as long as BBTrend remains above zero, the uptrend is still intact, supporting the potential for CRO’s price to continue rising.

Can Cronos Surge 100% in the Coming Weeks?

Cronos recently surpassed the $0.10 mark for the first time since early February.

Exponential Moving Average (EMA) indicators are painting a bullish picture, with short-term EMAs positioned above long-term EMAs and maintaining a healthy gap between them—a typical sign of strong upward momentum.

If this trend continues, CRO could target the next resistance levels at $0.12, followed by $0.149 and $0.166.

If a strong rally occurs, reaching the $0.20 level is possible. This would mark its highest price since late 2024, when discussions about a potential CRO ETF could attract further attention soon.

However, if bullish momentum starts to weaken, CRO may retrace to key support at $0.093. A break below this level could accelerate the correction, with the next downside targets at $0.082 and $0.068.

All information provided on our website is published in good faith and for general informational purposes only. Any actions taken by readers based on the information found on our website should be carefully evaluated, as they assume full responsibility for their own decisions.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger