Summary

The U.S. government shutdown may be a political crisis, but for digital asset markets, it has sparked an unexpected rally. In just one week, Crypto Inflows surged to a record-breaking $6 billion, signaling renewed confidence among investors seeking refuge from traditional finance uncertainty.

This wave of capital underscores the evolving role of cryptocurrencies as an alternative asset class — one increasingly viewed as a hedge against fiscal instability and government gridlock. Let’s break down what’s driving these record Crypto Inflows, which assets are benefiting most, and what it could mean for the months ahead.

What Happened: A Political Crisis Sparks a Market Response

As the U.S. government faced another funding deadlock, investor confidence in traditional markets began to waver. Treasury yields rose, stock markets dipped, and the dollar weakened. Historically, such uncertainty pushes investors toward safe-haven assets like gold. But in 2025, that narrative has shifted.

This time, much of the capital flowed into crypto markets, particularly into Bitcoin, Ethereum, and stablecoin-related funds. The record Crypto Inflows suggest that investors now see digital assets not just as speculative tools, but as part of a larger, resilient financial ecosystem.

Institutional players appear to have led the move, reallocating portions of their portfolios from bonds and equities into spot Bitcoin and Ethereum exchange-traded products (ETPs). Retail investors followed suit, drawn by the idea of holding assets that operate outside the reach of government shutdowns and fiscal disputes.

Breaking Down the $6 Billion Crypto Inflows

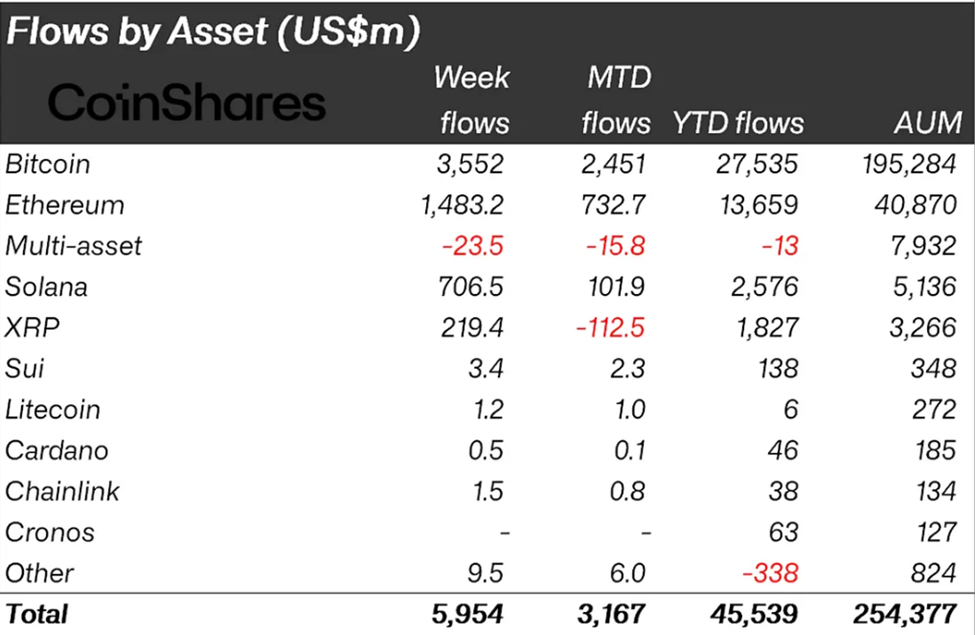

According to market data, this is the largest single-week inflow into digital assets since mid-2021. Here’s how that $6 billion wave is distributed:

| Asset Type | Share of Inflows | Key Drivers |

|---|---|---|

| Bitcoin | 65% | Safe-haven narrative, ETF demand |

| Ethereum | 20% | Anticipation of staking rewards and DeFi revival |

| Altcoins | 10% | Selective rotation into high-cap tokens (SOL, AVAX) |

| Stablecoins & Yield Funds | 5% | Flight to yield-bearing stable assets |

The biggest story remains Bitcoin, which alone attracted nearly $4 billion in new capital. The launch of several U.S.-listed spot Bitcoin ETFs earlier this year made it easier for both institutions and individuals to gain exposure through regulated channels.

Why the Shutdown Boosted Crypto Confidence

- Erosion of Trust in Government Stability

The prolonged budget stalemate reminded investors how dependent traditional systems are on political decision-making. Crypto, by contrast, operates on code, not Congress. - Liquidity Migration

As short-term Treasury yields spiked, some investors took profits from fixed income and reallocated to digital assets, hoping to ride post-shutdown market recovery. - Inflation & Fiscal Concerns

Every government shutdown raises questions about long-term fiscal discipline. Crypto, especially Bitcoin, continues to be marketed as “digital gold” — a store of value immune to central bank policy. - Global Diversification

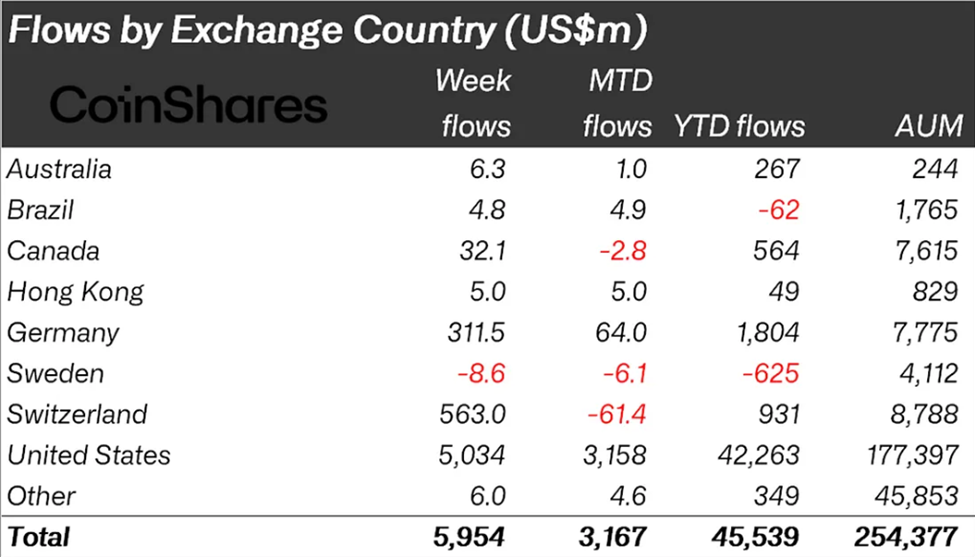

Non-U.S. investors used the event as a chance to diversify portfolios and reduce dollar dependency. This international participation helped accelerate total Crypto Inflows.

Institutional Sentiment Shifts

For years, institutional adoption has been the missing piece in mainstream crypto growth. But recent months have seen major shifts. Hedge funds and asset managers are not only buying spot crypto — they’re increasingly integrating blockchain-based yield products, tokenized treasury funds, and even staking strategies.

The Crypto Inflows tied to this event show that institutions are now treating digital assets as part of their core strategy rather than a fringe bet. The shutdown merely accelerated an existing trend: the slow but steady migration of capital into decentralized markets.

What It Means for the Broader Market

The $6 billion in Crypto Inflows isn’t just a short-term reaction — it could reshape market dynamics heading into 2026. Here’s what to watch:

- Higher Market Liquidity: More inflows mean more stable trading volumes and narrower bid-ask spreads, a healthy sign for market depth.

- Bitcoin Dominance Growth: Bitcoin’s share of total crypto capitalization rose above 52%, reflecting its continued role as the industry’s safe-haven asset.

- Renewed DeFi Activity: Ethereum’s inflows are boosting liquidity in decentralized finance platforms, potentially reigniting yield opportunities.

- ETF Market Expansion: The success of Grayscale and BlackRock’s ETFs could inspire other issuers to launch staking and DeFi-linked products.

If the U.S. government faces continued fiscal uncertainty, further inflows could push the total 2025 number beyond $25 billion — a level unseen since the last major bull cycle.

Risks to Watch

Despite the positive narrative, investors should remain cautious.

- Volatility: Rapid inflows often lead to speculative price surges, followed by sharp corrections.

- Regulatory Reactions: Policymakers may revisit crypto regulation as digital assets gain prominence during political crises.

- Market Overcrowding: As capital floods in, valuations can become stretched, creating short-term bubbles.

- Macro Uncertainty: If the shutdown persists or worsens, overall liquidity in financial markets could decline, impacting crypto too.

While the record Crypto Inflows are bullish in the short term, sustainable growth will depend on continued adoption and clearer regulatory frameworks.

The Bigger Picture: Crypto as a Parallel System

The U.S. government shutdown has unintentionally reinforced one of crypto’s founding ideas — independence from centralized systems. Every political stalemate, debt ceiling debate, or fiscal standoff reminds investors why decentralized finance exists in the first place.

In 2025, Crypto Inflows are no longer driven purely by speculation. They’re part of a broader movement toward financial autonomy and diversification. Whether this momentum continues will depend on how well the industry maintains transparency, stability, and innovation.

But one thing is clear: with $6 billion pouring into digital assets during a government crisis, crypto has officially moved from the margins to the mainstream.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk