Summary

Crypto staking has quickly become one of the most popular ways for investors to earn passive income from digital assets. By locking up your tokens to support a blockchain network, you can earn rewards over time—often with minimal effort. But how exactly does staking work, and is it the right move for your investment strategy? Let’s dive in.

✅ What Is Crypto Staking?

At its core,earning rewards involves committing your digital coins to a blockchain that uses a Proof of Stake (PoS) or similar consensus mechanism. Instead of mining, these networks rely on participants (called validators or delegators) who “stake” their tokens to help validate new transactions and maintain security.

In return for their participation, these individuals earn rewards—typically in the form of more digital asset currency.

📈 How Does Staking Generate Income?

When you stake your digital asset assets, you’re contributing to the network’s functionality and stability. As a reward, the network distributes newly minted tokens or transaction fees to you.

Think of it like earning interest from a savings account. The more tokens you stake—and the longer you lock them up—the more potential rewards you may earn.

🔄 Types of earning rewards

There are several methods available for investors who want to get started:

1. Self-Staking (Validator Node)

If you have a large number of tokens and technical know-how, you can run your own validator node. This allows you to earn higher rewards but comes with greater responsibilities and risks.

2. Delegated Staking

For most retail investors, delegated earning rewards is the go-to option. You simply delegate your tokens to an existing validator, and they share the rewards with you. It’s easier, more accessible, and doesn’t require complex setup.

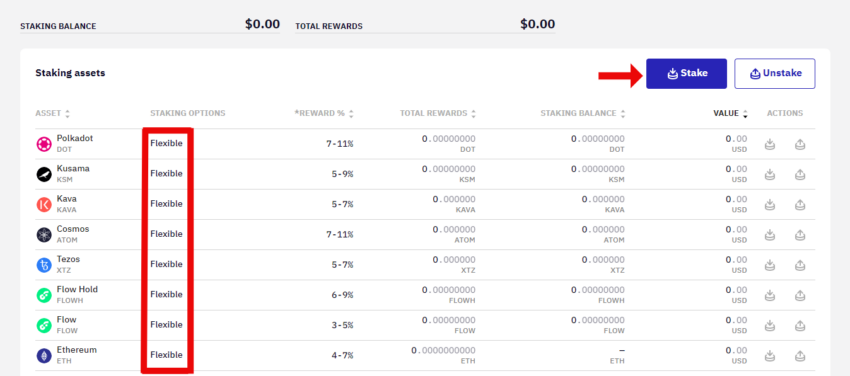

3. Staking Through Exchanges

Major digital asset platforms and wallets offer simple validator participation services. You deposit your tokens, and the platform handles the rest. This is the most beginner-friendly option, but fees may reduce your earnings.

🛑 Risks to Be Aware Of

While validator participation sounds like easy money, it’s not risk-free:

- Lock-up Periods: Some networks require you to lock your tokens for a fixed time. Early withdrawal may not be allowed.

- Market Volatility: The value of your staked assets may drop during the lock-up period.

- Validator Risk: Poorly performing validators may reduce your rewards—or worse, result in penalties.

🧠 Things to Consider Before You Stake

- Understand the blockchain’s staking rules and reward structure.

- Research validators or platforms offering validator participation services.

- Diversify your holdings to avoid overexposure to one network.

🚀 Popular Assets for Crypto Staking

Some of the most common tokens available for earning rewards include:

- Ethereum (ETH, after the transition to PoS)

- Cardano (ADA)

- Polkadot (DOT)

- Solana (SOL)

- Tezos (XTZ)

Each network offers different annual percentage yields (APY), so it’s important to compare them before committing your assets.

🏁 Final Thoughts

Crypto staking presents a unique opportunity to earn rewards while supporting the security and functionality of blockchain networks. Whether you’re a long-term holder or just exploring new income streams, earning rewards can be a smart addition to your investment toolkit.

As with any financial decision, weigh the risks, start small, and stay informed.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk