Summary

Prop trading (proprietary trading) allows skilled traders to access a firm’s capital instead of risking personal funds. Traders retain a percentage of profits, while lessons learned during evaluation phases and structured environments offer a unique launchpad to scale faster. While prop trading has long existed in forex (foreign exchange), crypto prop trading is rapidly emerging as the preferred path for many traders.

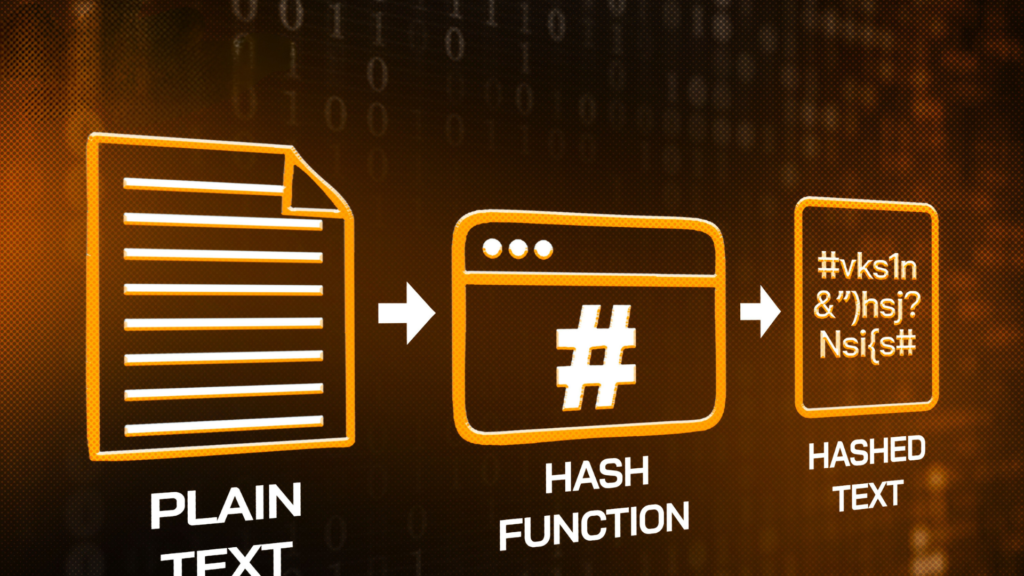

🧠 What Is Prop Trading?

Prop trading involves trading with capital supplied by a proprietary firm or brokerage. Traders may start with simulated challenges—hit profit targets, manage drawdowns, and prove consistency—to qualify for a funded live account. In return, they usually earn a split of the profits, while the firm takes a cut. Personal financial liability is often limited to evaluation fees and potential penalties for risk breaches.

📊 Comparing Crypto Prop Trading vs Forex Prop Trading

⏰ Trading Hours

- Forex: Active 24 hours a day, Monday through Friday.

- Crypto: Markets run 24/7, offering round-the-clock trading—even on weekends and holidays.

⚡ Volatility & Profit Potential

- Forex: Generally less volatile; price moves often gradual and predictable.

- Crypto: Highly volatile—can move 10‑20% in hours—allowing for bigger intraday profits but higher risk.

⚖️ Leverage

- Forex: Retail traders face strict regulations—typically capped at 30:1 leverage in many jurisdictions.

- Crypto: Prop firms often provide higher leverage (50:1 or more), though risk controls remain stringent.

⚖️ Profit Split & Scaling

- Crypto firms often offer higher profit splits (up to 90%) and faster scaling plans—unlocking larger capital based on performance.

- Forex firms may offer lower profit shares and more rigid growth path.

🌍 Regulation & Access

- Forex: Heavily regulated with limited access in certain regions; trading instruments are tightly controlled.

- Crypto: Regulatory frameworks remain evolving, offering wider global access but demanding cautious due diligence.

🛠️ Available Instruments

- Forex: National currencies and major pairs (< 10 major pairs).

- Crypto: Thousands of tokens available—including major coins and altcoins—creating a broader trading universe.

✅ Pros & Cons of Each Approach

Crypto Prop Trading

- ✅ 24/7 market with high volatility = more trading opportunities

- ✅ Large selection of cryptos for diverse strategies

- ✅ Flexible challenge formats and scaling options

- ❌ High risk from price spikes and weekend gaps

- ❌ Less regulatory oversight compared to forex

- ❌ Trading evaluation thresholds may be more stringent due to volatility

Forex Prop Trading

- ✅ Regulatory clarity, lower risk, stable markets

- ✅ High liquidity and tighter spreads

- ✅ Constrained volatility means slower but steady growth

- ❌ Fewer hours of trading access (no weekends)

- ❌ Less profit opportunity due to low volatility

- ❌ Lower capital scaling and slower challenge paths

🎯 Who Should Choose Which?

- Choose crypto prop trading if:

- You thrive in fast-paced, volatile environments

- You want flexible hours and global market access

- You enjoy trading multiple instruments and futures

- You’re willing to handle higher risk in exchange for bigger potential reward

- Choose forex prop trading if:

- You prefer predictable, regulated markets

- You value lower-risk environments and tighter spreads

- You trade primarily during business hours

- Your strategy benefits from macroeconomic analysis

💬 Real Feedback From Traders

In one discussion, a trader cautioned that prop trading can feel “like gambling,” noting many traders lose evaluation challenges. Only top performers often earn funding, highlighting the discipline needed to succeed.

Another user praised prop firms for fostering trader development, providing training, peer feedback, and structured risk management—especially in crypto-focused firms.

🛠️ Tips for Success in Prop Trading

- Start with evaluation challenges: Treat them like simulations—learn risk limits, consistency, and market tools.

- Choose the right model: Crypto firms may allow bots or news trading, while forex firms are more traditional.

- Focus on risk discipline: Many traders fail from violating drawdown or position-size rules.

- Scale gradually: Build performance before expanding capital.

- Keep up with regulations and tax rules—especially important in crypto—across your jurisdiction.

🧭 Final Thoughts

Prop trading—whether in crypto or forex—gives skilled traders access to capital, mentorship, and structured growth. Crypto prop trading often brings more flexibility, broader asset choices, and higher upside—but comes with greater risk. Forex prop trading offers stability, deeper regulatory structure, and predictable conditions.

Ultimately, the best path depends on your trading style, risk tolerance, and growth goals. Both offer the potential for professional-level trading careers without risking your own capital—if approached carefully and consistently.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk