Summary

Fidelity Digital Assets recently released a comprehensive report that raises intriguing possibilities for Ethereum’s future. Despite a tough first quarter marked by steep price declines and bearish technicals, key on-chain metrics suggest Ethereum may be currently undervalued—and positioned for a potential recovery. Let’s break down what’s driving this cautiously optimistic outlook.

1. Market Context: Q1 Volatility and Technical Pressure

Ethereum entered 2025 with impressive momentum, climbing to nearly $3,579 in January and sparking optimism among traders. Yet, by the close of the first quarter, the asset had faced a steep correction of around 45%. This downturn triggered significant technical signals, most notably the appearance of a “death cross,” where the 50-day moving average slipped beneath the 200-day—a pattern often linked to prolonged bearish sentiment. Still, despite the sharp pullback and caution in the market, Fidelity’s latest analysis points out that the broader picture may not be as bleak. Beneath the volatility, Ethereum continues to show structural resilience and underlying stability, suggesting that its long-term fundamentals remain intact even in the face of short-term turbulence.

2. On-Chain Metrics Signal Undervaluation

Fidelity’s report draws attention to two powerful valuation indicators:

- MVRV Z-Score fell to around –0.18, a level historically aligned with market bottoms and value opportunities.

- Net Unrealized Profit/Loss (NUPL) settled near 0, marking a “capitulation” point where unrealized gains and losses are balanced—often a time when holders stop selling in panic.

These metrics suggest that long-term holders are holding their ground while speculative selling has subsided, strengthening the possibility of a bottom forming.

3. Institutional and Network Indicators: A Deeper View

Despite the recent downturn in price, Ethereum’s underlying network activity paints a much more optimistic picture. One of the strongest signals of resilience comes from the rapid expansion of Layer-2 platforms. With Ethereum now supporting over 13.6 million active addresses, the network continues to demonstrate scalability improvements and growing user adoption, even during periods of market weakness. This level of engagement suggests that developers, businesses, and individual users alike still see Ethereum as the primary settlement layer for decentralized applications.

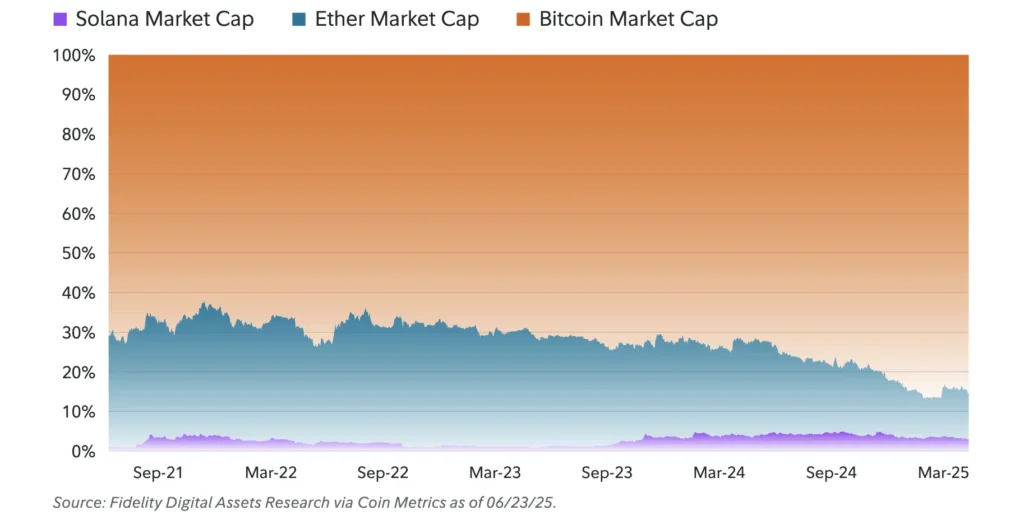

Additionally, Ethereum’s market capitalization relative to Bitcoin has declined to levels not witnessed since mid-2020. For many investors, this creates a potential contrarian opportunity: while market sentiment remains cautious, Ethereum’s valuation may actually be undervalued compared to its historical standing and future potential. These on-chain and market indicators together highlight that, beyond short-term volatility, Ethereum’s ecosystem is experiencing steady growth. Its expanding role in decentralized finance (DeFi), NFTs, and enterprise adoption continues to reinforce its position as a foundational infrastructure asset in the blockchain economy.

4. Early Technical Rebound: Small Signs of Life

While broader sentiment remains cautious, a few technical indicators hint at stabilization:

- Ethereum price has risen above the 12-hour Ichimoku Cloud, which could indicate a short-term trend reversal.

- Combined with the other signals, it suggests that Ethereum may be setting the stage for a recovery phase—even if modest.

5. Risks and Caveats Ahead

Despite these bullish undertones, uncertainties persist:

- History shows that even after MVRV signals undervaluation, prices can continue lower before rebounding—e.g. during mid-2022.

- Ongoing macroeconomic turbulence and regulatory unpredictability could hinder short-term recovery.

- Market sentiment may remain fragile while broader risk assets are under pressure.

6. Why This Matters for Ethereum Investors

Here’s how different groups should interpret the findings:

| Investor Type | Consideration |

|---|---|

| Long-term holders | May see this as a strategic accumulation window based on fundamental indicators. |

| Technical traders | Watch for confirmation of reversal via price/volume action and MACD/RSI signals. |

| Institutional players | Declining BTC dominance in market share may hint at renewed confidence in ETH. |

Final Thoughts

Fidelity’s analysis paints Ethereum as a potentially undervalued asset—despite recent downturns—thanks to a combination of on-chain metrics, ecosystem strength, and technical cues. While short-term volatility can’t be ruled out, the data suggests a compelling case for Ethereum’s medium- to long-term value proposition.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk