In summary

Strategy (formerly MicroStrategy) is issuing $2 billion in convertible bonds to buy more Bitcoin.

Michael Saylor confirmed no Bitcoin purchases last week, pausing the company’s regular buying streak.

Bitcoin’s consolidation below $100,000 could give Strategy an opportunity to accumulate more BTC at favorable prices.

promo

Trade on BYDFi and have a chance to win an iPhone 16, Rolex watch…!

Strategy (formerly MicroStrategy) is undertaking a private offering of senior convertible bonds. The company will offer $2 billion of these assets and use the proceeds to buy more Bitcoin.

Saylor announced that his company has not purchased additional Bitcoin in the past week, pausing its buying trend. However, aside from this detail, everything else appears to be within his standard buying plan.

Strategy Continues Buying Bitcoin

Since MicroStrategy (recently renamed Strategy) began buying Bitcoin, it has become one of the largest BTC holders worldwide. Earlier this month, the company broke its 12-week streak of consecutive purchases, quickly resuming it afterward.

Today, Michael Saylor acknowledged that the company has paused its buying once again, but not for long

Last week, Strategy did not sell any shares of its Class A common stock under the at-the-market equity offering program, and it did not buy any bitcoin. As of February 17, 2025, we hold 478,740 BTC acquired for approximately $11.8 billion at an average price of approximately $30,860 per bitcoin,” Saylor stated.

Specifically, just hours after Saylor posted this first update, he followed up with another announcement. The company is planning a private offering of $2 billion in aggregate principal amount of senior convertible notes.

These stock offerings, of course, will help Strategy fund the purchase of even more Bitcoin. This is a technique the company has used before, having conducted a similar offering just last month.

Strategy has employed a few different tactics to continue these massive Bitcoin buys. The company has sold enough stock that BlackRock now owns 5% of the company, and the company’s Strike (STRK) incentive stock has seen strong performance. The company’s formidable BTC reserve has increased significantly in value, but the company is still holding strong on these assets.

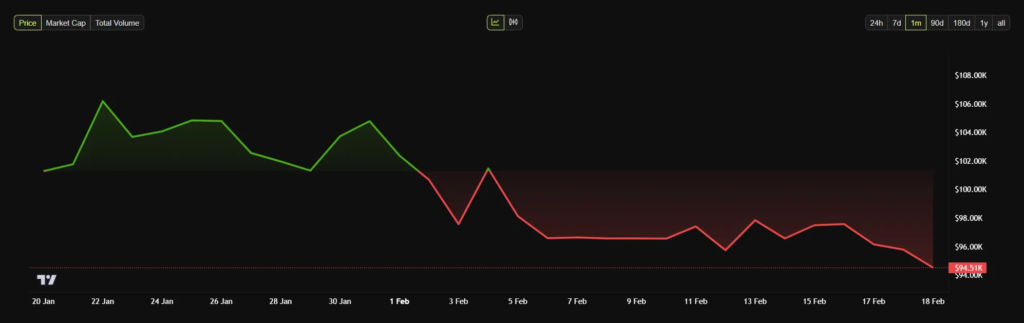

Bitcoin’s price has been somewhat volatile in the past few weeks, which could present an opportunity for Strategy. After its ups and downs, its price is converging right below $100,000. This isn’t a major discount in the grand scheme of things, but it will still get Strategy more assets for the same investment.

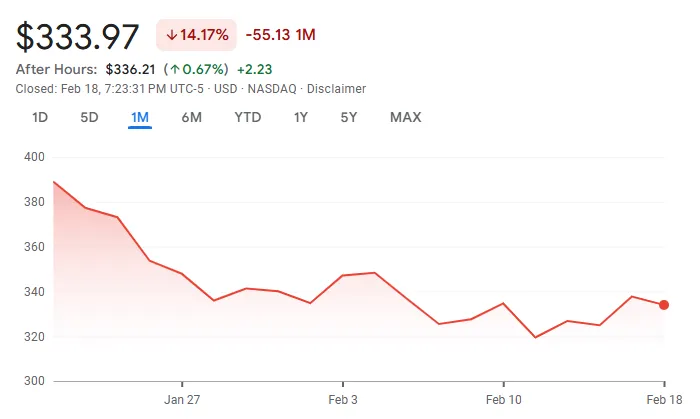

Meanwhile, MSTR stock hasn’t been performing well recently either. It remains down nearly 15% over the past month.

Ultimately, this whole operation seems pretty textbook. Strategy has clearly stated its intention to buy more Bitcoin with this stock sale, just like several other recent offerings.

Despite rumors that the company might be struggling to execute this strategy, they haven’t materialized. For now, Saylor appears content with the same outlook – maximum optimism.

All information provided on our website is published in good faith and for general information purposes only. Any action readers take upon the information found on our website is strictly at their own discretion and risk.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger