Summary

OKX trading bots offer a powerful way to automate your crypto strategy—ideal for both beginners and advanced traders. From AI-driven automation to grid and arbitrage strategies, these bots eliminate emotion, enhance execution speed, and operate 24/7 across global markets. Let’s explore how they work, how to set them up, and why they’ve become a go-to tool for modern crypto traders.

🧠 What Are OKX Trading Bots?

Trading bots are software programs that automatically execute trades based on predefined parameters. On the OKX platform, users can access a variety of bots designed for both beginners and pros, including:

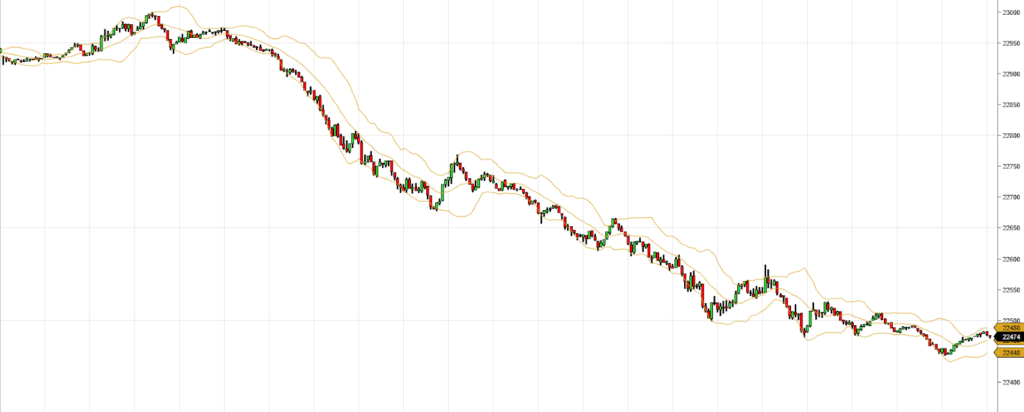

- Grid bots (for spot and futures trading) – place buy and sell orders at set intervals within a price range

- DCA bots – spread out investments over time to minimize market volatility

- Arbitrage bots – profit from price differences across markets or pairs

- TWAP bots – distribute large orders to reduce price impact

- Signal bots – trade based on integrated market indicators

- Copy trading bots – replicate strategies used by top traders

These bots are built to help traders act fast, eliminate emotional bias, and maintain consistency even during volatile markets.

🚀 How to Set Up OKX Trading Bots

Setting up a bot is quick and intuitive:

- Choose a Strategy

Decide whether you want a grid bot, DCA bot, arbitrage bot, or another strategy. OKX provides default templates and AI-enhanced suggestions. - Customize Your Bot

Input key parameters such as price range, investment amount, leverage (if applicable), stop-loss, and take-profit limits. AI optimization is available for certain bots like Moon Grid. - Launch and Monitor

Once you deploy the bot, you can monitor its performance in real-time. Many bots offer backtesting features to simulate potential returns before going live.

✨ Why Traders Choose OKX Bots

🧠 AI Optimization

Some bots on the platform use AI to automatically adjust trading ranges and order spacing based on real-time market conditions, helping improve profitability.

🧩 Wide Strategy Selection

With bots for grid trading, DCA, arbitrage, TWAP, smart portfolios, and more, traders have a broad toolkit to choose from.

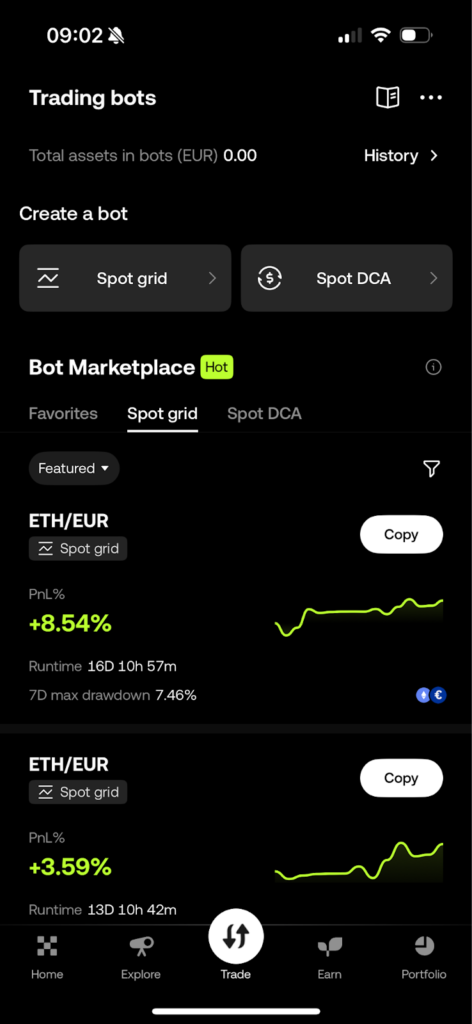

🤝 Copy Trading Marketplace

The platform features a marketplace where you can copy professional strategies or share your own for others to follow. Great for those seeking passive trading income.

⏳ 24/7 Execution

Bots run around the clock, executing trades the moment market conditions match your parameters—no manual input required.

🔐 Built-In Risk Controls

Set clear stop-loss, take-profit, and trailing stop rules to manage downside risk effectively.

✅ Pros & Cons

| ✅ Pros | ❌ Cons |

|---|---|

| Full automation with zero emotions | Requires learning curve for beginners |

| Variety of bots for different strategies | Poor setup can result in losses |

| AI-powered optimization on some bots | High-leverage use increases risk |

| 24/7 trading without manual input | May not work in highly volatile or illiquid markets |

| Marketplace access to expert strategies | Not available in all jurisdictions |

🎯 Who Should Use These Bots?

- Day traders looking for 24/7 automation

- Investors who want passive income via recurring buy or copy trading bots

- Experienced traders who manage complex strategies with stop-loss, take-profit, and grid logic

- Newcomers exploring algorithmic trading in a simplified format

These bots are especially helpful for traders who struggle with emotional decision-making or don’t have time to monitor markets constantly.

⚠️ Best Practices & Risks

- Know Your Strategy

Understand how each bot type works before deploying. Avoid setting random parameters—stick to logic backed by your market outlook. - Avoid Over-Optimization

Don’t base decisions purely on historical backtesting. Market conditions change. Use conservative risk management. - Regular Monitoring

While bots are automated, periodic checks help you stay on top of performance and make adjustments if needed. - Start Small

Begin with small amounts while testing a new strategy. Once you’re confident, scale up your bot operation gradually. - Understand Platform Limits

The service is not accessible in certain countries due to regulatory reasons, so always verify platform availability.

📊 Real-World Scenarios

- Grid Bot on BTC/USDT: Set a range of $55,000–$65,000 with 10 grid levels. The bot will buy low and sell high repeatedly, profiting from volatility.

- DCA Bot for ETH: Invest $100 every Monday at market price. This smooths out price fluctuations over time and builds a long-term position.

- Arbitrage Bot Example: Identify price gaps between two trading pairs and execute simultaneous buy/sell orders to profit from inefficiencies.

🧠 Final Thoughts

OKX trading bots are powerful tools for anyone looking to streamline and automate their crypto trading. With a variety of strategies, AI enhancements, and copy-trading options, they allow users to participate in markets efficiently, without the stress of constant monitoring.

That said, successful bot trading depends on good setup, realistic expectations, and solid risk control. These tools are best suited for those who are informed, strategic, and committed to active review—even in an automated world.

Want help optimizing your strategy or choosing the right bot for your portfolio? I’m here to guide you.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk