Introduction

Summary

Pi Coin, a cryptocurrency project known for its unique mobile mining model and fast-growing community, is now under increasing pressure as Bitcoin’s sharp price swings continue to shake the broader market. While its innovative approach has attracted significant attention, recent market conditions and underlying structural challenges are raising questions about Pi Coin’s long-term price trajectory.

This article explores the potential impact of Bitcoin’s volatility on this digital currency, current market dynamics, project fundamentals, and what investors should keep in mind before engaging with this emerging cryptocurrency.

Bitcoin’s Influence on Pi Coin

Bitcoin’s dominance in the crypto ecosystem is undeniable. Historically, when Bitcoin experiences significant downward momentum, smaller tokens and newer projects such as Pi Coin tend to follow suit. Recent corrections in Bitcoin have created additional headwinds, with analysts suggesting that this digital currency could be pushed toward new lows if bearish sentiment continues.

Since this digital currency is still in a transitional phase—working toward listing on major exchanges and establishing broader liquidity—it is particularly vulnerable to Bitcoin’s price shocks. Unlike established altcoins with proven utility, Pi Coin’s valuation remains heavily speculative, making it more sensitive to broader market shifts.

Pi Coin’s Unique Value Proposition

Despite the challenges, this digital currency stands out due to its mobile-first approach. The project allows users to mine Pi directly from their smartphones without consuming significant energy, making it accessible to a global audience that may not have the resources for traditional mining operations.

This accessibility has fueled a rapidly growing community, with millions of users engaging daily. The strong user base remains one of Pi Coin’s biggest strengths, highlighting the project’s potential for mainstream adoption if it successfully transitions to a fully operational blockchain with exchange listings.

Market Sentiment and Challenges

Pi Coin’s community-driven momentum has created excitement, but it also faces skepticism. Critics argue that until the token achieves liquidity and is listed on more exchanges, its price will remain highly speculative.

Market sentiment has also shifted in recent months, with investors becoming more cautious in the face of Bitcoin-driven volatility. This creates an environment where speculative assets like Pi Coin may struggle to maintain upward momentum.this digital currencyMarket sentiment has also shifted in recent months, with investors becoming more cautious in the face of Bitcoin-driven volatility. This creates an environment where speculative assets like Pi Coin may struggle to maintain upward momentum.

Furthermore, regulatory uncertainty continues to weigh on the project. Sincethis digital currency is still in development, questions remain about compliance, governance, and whether its eventual listing process will satisfy investor protection standards in key markets.

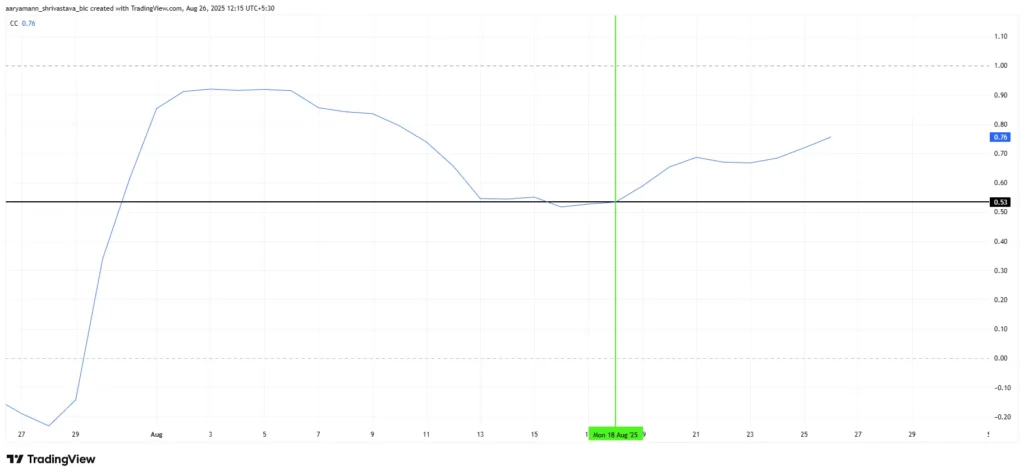

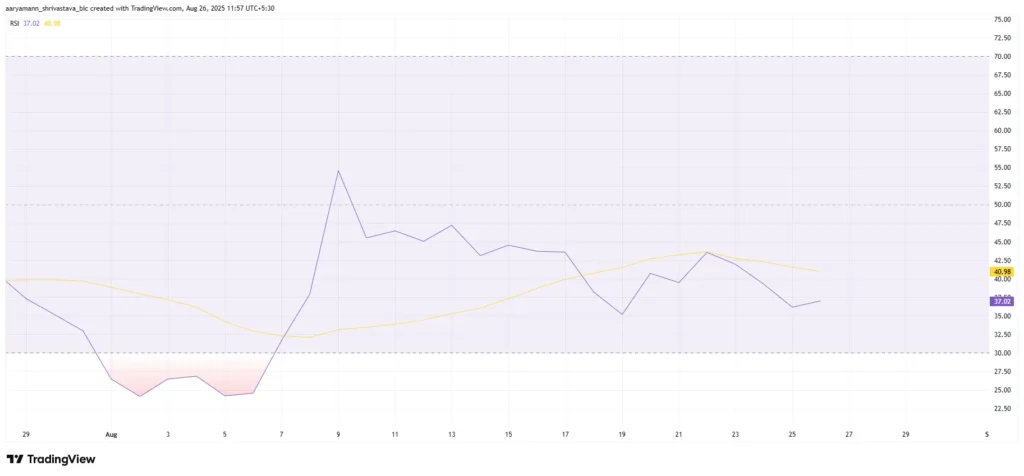

Technical Factors and Potential Price Movement

From a technical perspective, analysts caution that this digital currency may face further downside if Bitcoin continues its bearish trend. Without strong independent fundamentals, Pi Coin’s price could test new lows, creating challenges for both early adopters and newcomers hoping for quick gains.

However, technical pullbacks in speculative assets can also create entry points for long-term believers. If the this digital currency network successfully rolls out its mainnet and expands its ecosystem of decentralized applications (dApps), demand for the token could strengthen in the future.

Community Strength as a Long-Term Asset

One of Pi Coin’s most notable features is its vast community. With millions of active users mining and promoting the project, Pi Coin has one of the largest grassroots movements in the crypto world. This level of engagement suggests that even in times of price weakness, the project may retain strong interest from its supporters.

If Pi Coin is able to channel this community into real-world use cases, partnerships, and ecosystem development, it may build sustainable demand beyond speculation. The transition from hype to utility will be critical in determining whether this digital currency can thrive in the long term.

Outlook for Pi Coin in 2025

Looking ahead, the trajectory of Pi Coin will likely depend on three key factors:

- Bitcoin’s Market Performance – As the leading cryptocurrency, Bitcoin’s direction will heavily influence Pi Coin’s short-term price action.

- Exchange Listings and Liquidity – Achieving widespread listings and access to liquidity is essential for Pi Coin’s growth and legitimacy.

- Ecosystem Development – The rollout of decentralized applications and real-world use cases will determine whether this digital currency transitions from a speculative token to a functional digital asset.

Conclusion

While this digital currency continues to attract a loyal and growing community, it faces challenges tied to Bitcoin’s market dominance and its own developmental hurdles. A continued Bitcoin downturn could place further pressure on this digital currency, potentially driving it toward new lows.

Nevertheless, the project’s innovative mobile-first mining model and strong grassroots support suggest it still holds long-term potential. For investors, the key lies in balancing optimism with caution—acknowledging both the risks of short-term volatility and the opportunities presented by Pi Coin’s evolving ecosystem.

As with any cryptocurrency investment, due diligence, risk management, and a clear strategy remain essential. Pi Coin’s future may hinge not only on market conditions but also on the project’s ability to deliver on its promises and carve a sustainable niche within the broader digital asset landscape.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk