Summary

Privacy Coins are gaining renewed attention as Zcash’s sharp rally sparks fresh interest in privacy-focused digital assets. Known for its shielded transactions and cryptographic anonymity, Zcash’s surge has created what many call the Zcash Effect — a momentum shift that could boost low-cap privacy coins with similar or complementary features. As traders rotate profits and the privacy narrative strengthens, several small-cap projects are emerging as potential winners. Here’s a look at which ones might ride the wave and what risks investors should watch out for.

What Is the Zcash Effect?

The Zcash Effect refers to increasing demand for privacy coins sparked by Zcash’s performance. Its price has climbed to multi-year highs amid rising interest in transaction privacy, shielded pools, and zero-knowledge proof technologies. This youthful momentum often causes spillover into other coins in the sector.

Investors are now asking: Which smaller projects could gain from Zcash’s renewed visibility? Which ones already share technical privacy features, or are well-positioned to adapt?

Low-Cap Projects Already Showing Signs

Here are a few low-cap privacy coins that could particularly benefit from the current trend:

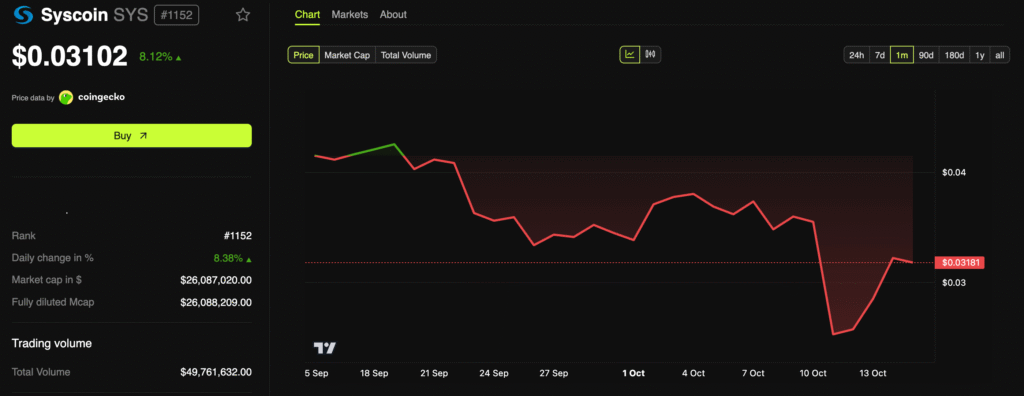

1. Syscoin (SYS)

- Combines Bitcoin’s security (through merge-mining) with smart contract functionality; hybrid architecture could appeal as privacy becomes more important.

- Recent data show trading volume jumping dramatically while market cap remains relatively modest, indicating speculative momentum and rising interest.

- On-chain activity (number of accounts) is increasing, which suggests growing adoption.

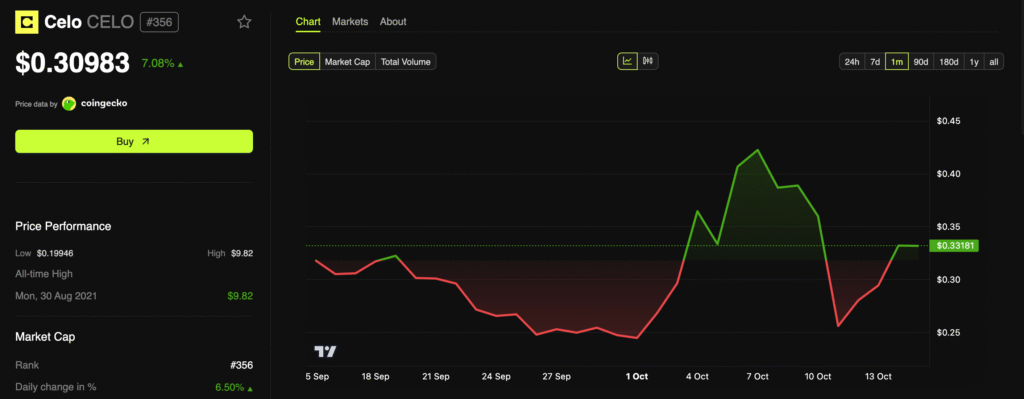

2. Celo (CELO)

- Traditionally focused on payments and mobile access, but now integrating a zero-knowledge privacy layer (Nightfall) which provides optional privacy features while maintaining speed and affordability.

- Gains in trading volume and interest from retail investors in certain regions (e.g. South Korea) boost visibility.

- As general attention turns to privacy, Celo’s enhancements may make it more competitive in the privacy coin niche.

3. iExec RLC (RLC)

- Known for privacy tooling, data sovereignty, confidential computing. Developers using iExec aim to give users more control over data and who sees what.

- Recent project audits (security) and improvements around bridges or cross-chain tools add trust.

- Volume spikes suggest rising trader interest; technical upgrades or integrations could further bolster demand.

What Features Give Coins an Edge

To truly benefit from the Zcash Effect, low-cap privacy coins will likely need to satisfy certain criteria:

- Strong privacy primitives — whether zero-knowledge proofs, shielded pools, confidential transactions, or zk-SNARK/zk-STARK implementations.

- Developer activity & trust — audits, secure bridges, compatibility, transparency.

- Volume and ecosystem momentum — actual usage or speculative trading triggers; small-cap coins often surge when market attention focuses on their sector.

- Regulatory clarity or optional privacy (so users can in theory comply, yet preserve anonymity when needed).

- Real-world use cases or integrations — payments, confidential computing, data privacy, on-chain privacy tools.

Risks That Come Along

Of course, chasing privacy coins carries extra risk:

- Regulatory scrutiny — governments often view privacy tokens with suspicion. Delistings or restrictive rules may arise.

- Low liquidity & high volatility — smaller coins tend to swing wildly. Gains can be pronounced, but losses too.

- Technical vulnerabilities — privacy tech is complex. Bugs, misconfigurations, or trust assumptions (e.g. zk-setup) can amplify risk.

- Limited adoption — optional privacy features might not be used by all users, reducing the practical privacy set.

Strategic Moves for Investors

If you believe in the momentum of privacy coins, here are ways to approach:

- Diversify selection — pick several low-cap privacy coins rather than betting everything on one.

- Watch for audits & updates — security audits, technical upgrades often precede upward price moves.

- Monitor trading volume & on-chain metrics — spikes in trade volume, increase in usage metrics often signal that demand is building.

- Stay informed on policy/regulation — changes in AML, KYC laws, or national crypto policy can be game changers.

- Set exit/Taking profit plans — given volatility, define your gains/loss thresholds in advance.

Outlook

With Zcash blazing a trail, it’s likely more low-cap privacy coins will see attention and inflows in coming weeks or months. Those that combine technical privacy strength, adoption, and regulatory-friendly behavior might benefit the most. Projects like Syscoin, Celo, and iExec RLC are already catching eyes and could outperform if the sector continues its resurgence.

However, the era of privacy coins may also force the market to reckon with deeper issues — usability, regulation, and trust. The coins that survive this phase will be those that address these challenges while maintaining innovation.

Conclusion

The Zcash Effect is reshaping sentiment in the privacy coin sphere. Low-cap tokens with strong privacy features are well-positioned to ride this wave, but they won’t all succeed. By carefully assessing technical merit, community trust, and regulatory environment, investors can spot the ones with real potential. For those who bet smart, this could be a season of outsized gains — but for others, sharp risks lie ahead.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk