In Summary

Solana is oversold, with the RSI dropping below 30 for the first time since June 2023, signaling a potential rebound. Market sentiment is at its lowest in over a year, suggesting capitulation, which often precedes a price recovery.

Key support at $136.62 is holding, and if buying pressure returns, SOL could rise to $182.31 and potentially reach $222.14.

Promo:

Trade on BYDFi and get a chance to win prizes like an iPhone 16, a Rolex watch, and more!

Solana has witnessed a significant wave of profit-taking since reaching its all-time high of $295.83 on January 19th. This has pushed its price down to multi-month lows, with the coin currently trading at levels last seen in October.

However, on-chain data and key technical indicators suggest a recovery may be imminent.

Solana Reaches Capitulation Phase – What’s Next for SOL?

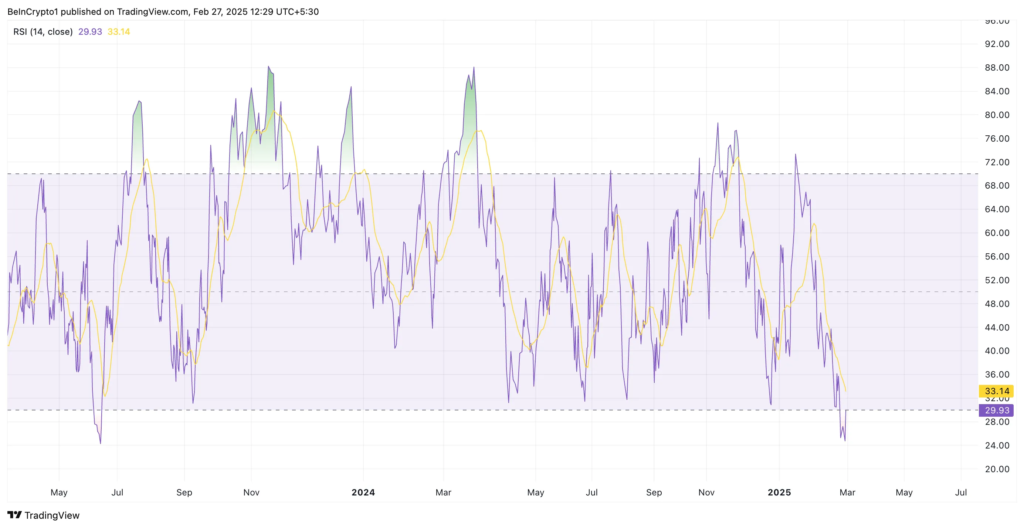

An assessment of the SOL/USD 1-day chart reveals that the coin’s Relative Strength Index (RSI) has dropped below 30 for the first time since June 2023. This signifies that SOL is oversold, indicating that selling pressure may be exhausted and a price correction could be underway.

When an asset’s RSI drops below 30, it is considered oversold. This typically signals a potential price reversal or rebound as traders look for buying opportunities at lower prices. Historically, such oversold conditions have often preceded strong rallies.

Therefore, SOL could be poised for a price increase if market participants interpret this as a buying signal and increase their accumulation of the coin.

Another indicator of a potential short-term price recovery for SOL is the poor market sentiment. In a post on X, prominent crypto analyst Miles Deutscher noted that the altcoin is experiencing extreme bearish sentiment, the worst in over a year since it first reclaimed the $100 price level.

According to Deutscher, ‘after being one of the best-performing coins for a long time,’ SOL is ‘finally having its moment of capitulation.’ Capitulation refers to the phase when investors, exhausted by sustained losses, begin to sell off their assets in panic or frustration, often marking a market bottom.

This is because when these ‘paper hands’ sell, the selling pressure on the SOL market lessens, paving the way for a recovery if buyers interested in purchasing the coin at low prices step in.

SOL Hovers Near Key Support—Can Bulls Push It to $200?

SOL is trading at $141.67 at the time of writing, just above the $136.62 support level. If the altcoin sees an increase in buying pressure, this support level will be solidified, pushing SOL’s price towards $182.31, where there is significant resistance.

A successful break above this level could propel the coin’s price above $200 to trade at $222.14.

All information on our website is published in good faith and for general informational purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk, and they should re-evaluate it.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger