Summary

Stablecoin is a type of cryptocurrency designed to maintain a stable value over time. Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, which often experience wild price swings, a Stablecoin aims to keep its price consistent, typically by being pegged to a real-world asset like the US dollar, euro, or even gold.

This makes Stablecoins highly attractive for users who want the benefits of digital currency—such as fast transactions and blockchain transparency—without the volatility risk. But how do they work, and why are they gaining so much attention?

🌍 Why Stablecoins Matter in the Crypto World

While cryptocurrencies were initially introduced as alternatives to fiat money, their price volatility made them difficult to use in daily transactions. That’s where price-stable digital currencies come in. These assets serve as a middle ground between the reliability of traditional currencies and the innovation of blockchain systems.

They are ideal for merchants, traders, and everyday users looking for predictable value in the crypto space.

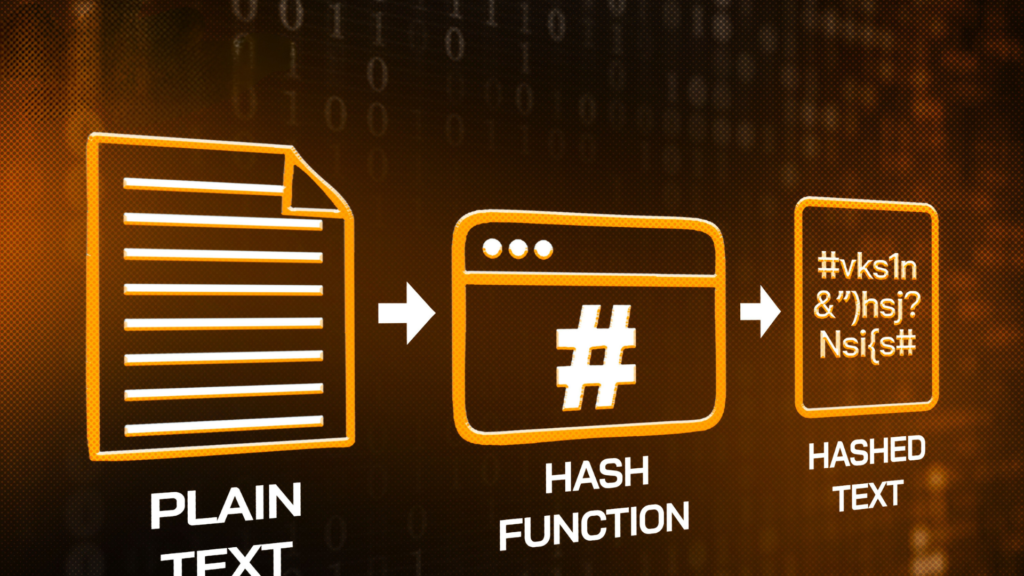

🧠 How Does a Stablecoin Work?

There are several models behind the mechanics of a Stablecoin:

1. Fiat-Collateralized Stablecoins

These are backed 1:1 by traditional currency like USD, stored in reserves managed by trusted institutions. Each Stablecoin issued has a corresponding fiat currency held to maintain its value.

2. Crypto-Collateralized Stablecoins

Instead of fiat, these Stablecoins are backed by other cryptocurrencies. To account for the volatility of the backing crypto, they are often overcollateralized.

3. Algorithmic Stablecoins

Rather than being backed by an asset, these rely on smart contracts and algorithms to automatically adjust supply and demand, keeping the price stable.

Each approach has its pros and cons, with trade-offs between trust, decentralization, and transparency.

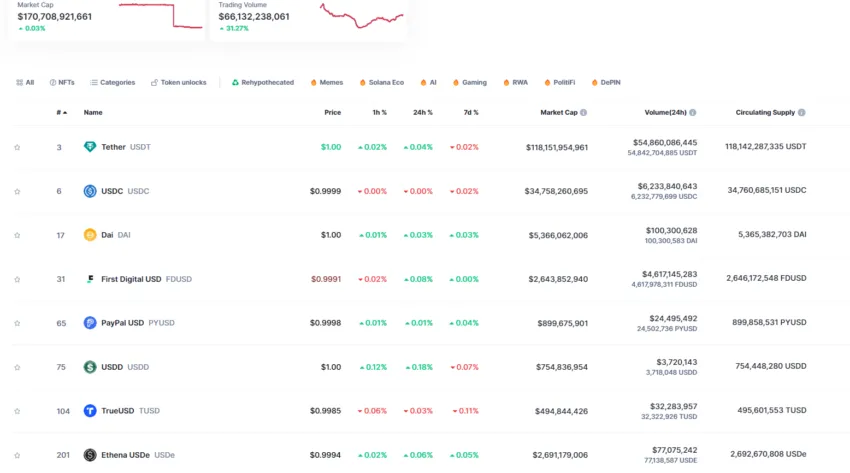

💡 Popular Examples of Stablecoins

Examples of widely used price-stable assets include:

- Tether (USDT): Pegged to the USD and one of the most traded digital assets.

- USD Coin (USDC): Known for its transparency and regulatory compliance.

- DAI: A decentralized option backed by crypto collateral and governed by smart contracts.

These options highlight the growing demand for price consistency within the broader crypto market.

🔐 Use Cases for Stablecoins

These digital assets serve a range of purposes beyond just avoiding volatility:

✅ International Transfers

Because they are fast and low-cost, they’re excellent for remittances and global payments.

✅ Decentralized Finance (DeFi)

They are core to DeFi ecosystems, used for lending, borrowing, and earning passive income through staking and farming.

✅ Digital Payments

They are increasingly accepted by online merchants and service providers, particularly in regions facing unstable fiat currencies.

⚠️ Risks and Considerations

Despite their appeal, there are risks involved:

- Regulatory Ambiguity: Governments are still determining how to oversee them.

- Centralized Trust: Fiat-backed tokens depend heavily on the credibility of issuing institutions.

- Loss of Peg: Algorithm-based assets may fail to maintain price stability during market stress, as seen in past failures.

Users should do their due diligence before relying on any single project.

🚀 The Future of Stablecoins

These digital tokens are quickly becoming foundational to the next generation of digital finance. Central banks, fintech firms, and crypto developers are all exploring how they can enhance global payment infrastructure.

As adoption spreads, these stable-value assets may be key to unlocking widespread use of decentralized financial systems.

Final Thoughts

Price-stable cryptocurrencies offer the innovation of crypto with the reliability of fiat. They’re versatile tools—suitable for savings, payments, and DeFi alike. Whether you’re new to crypto or a seasoned investor, understanding these tokens is crucial in the evolving digital economy.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk