Summary

Stablecoins have become one of the most transformative forces in the cryptocurrency market. By 2025, digital assets are smarter, more efficient, and increasingly stable — and stablecoins stand at the heart of this evolution. Acting as a bridge between traditional finance and decentralized systems, they bring reliability, liquidity, and accessibility to a world once dominated by speculation.

Once known simply as “crypto pegged to the dollar,” Stablecoins have transformed into versatile financial tools that provide stability, yield, and accessibility to millions of users worldwide. This article explores how Crypto-backed currencies work, the risks and rewards involved, and why they’re becoming essential to the modern crypto economy.

1. What Are Stablecoins?

Stablecoins are cryptocurrencies designed to maintain a fixed value, typically pegged to fiat currencies like the US dollar or the euro. Unlike volatile coins such as Bitcoin or Ethereum, stablecoins aim to preserve purchasing power — making them ideal for payments, remittances, and savings.

There are several types of Crypto-backed currencies, including:

- Fiat-backed (e.g., USDT, USDC) — backed 1:1 by cash reserves or short-term treasury assets.

- Crypto-backed (e.g., DAI) — supported by other cryptocurrencies locked in smart contracts.

- Algorithmic — rely on supply adjustments to maintain price stability.

In 2025, new forms of Stablecoins also include yield-bearing and real-world asset-backed versions, which offer both stability and potential income.

2. How Stablecoins Work

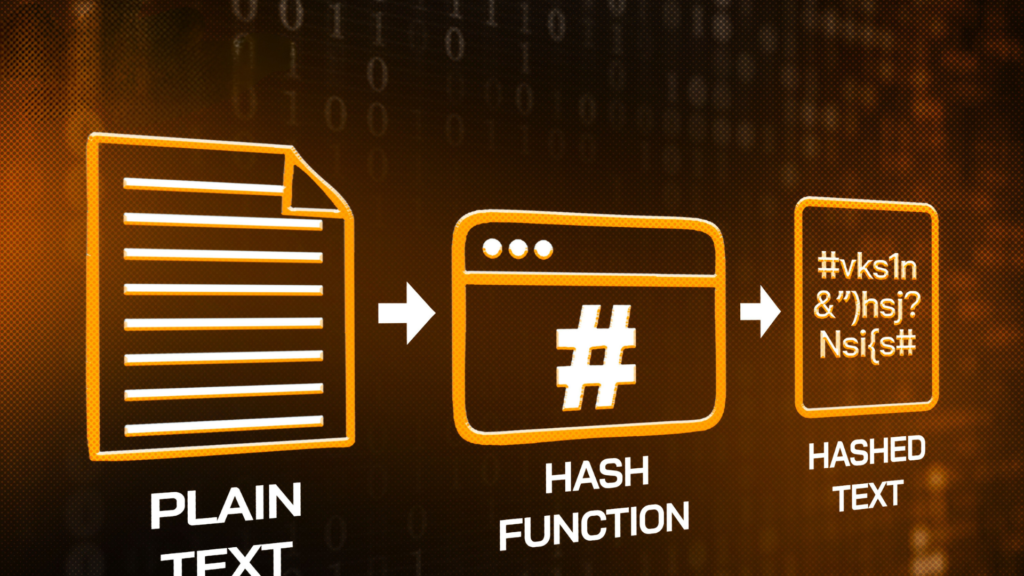

The main function of Stablecoins is to provide a stable store of value in an otherwise volatile market. They achieve this through collateralization or algorithmic mechanisms.

For instance:

- A fiat-backed stablecoin maintains its peg because each token is backed by an equivalent amount of fiat in a regulated bank account.

- A crypto-backed stablecoin over-collateralizes assets to ensure value even when the market fluctuates.

- Some yield-generating stablecoins invest reserves in short-term bonds or DeFi lending platforms to provide holders with passive income.

This blend of innovation and risk management has made Crypto-backed currencies one of the most practical instruments in digital finance.

3. Why Stable digital currencies Matter in 2025

The importance of Crypto-backed currencies has grown dramatically over the past few years. They now play a key role in global crypto transactions, decentralized finance (DeFi), and even cross-border settlements.

Here’s why they matter more than ever:

- Global Payments: Enable faster and cheaper international transfers.

- DeFi Utility: Serve as a foundation for lending, borrowing, and yield farming.

- Financial Inclusion: Give access to dollar-based assets in regions with unstable currencies.

- Institutional Adoption: Financial institutions are increasingly integrating Stablecoins into digital payment infrastructure.

By 2025, Stablecoins are no longer just a crypto convenience — they’re becoming a cornerstone of the new digital economy.

4. Benefits of Stablecoins

| Feature | Benefit |

|---|---|

| Price Stability | Pegged to fiat value, reducing volatility. |

| Liquidity | Instantly tradable across exchanges and platforms. |

| Transparency | Many stablecoins publish regular reserve audits. |

| Yield Potential | Some offer interest through DeFi or traditional assets. |

| Accessibility | Easy to send, receive, or use globally with a wallet. |

These advantages make Stablecoins an essential gateway for both beginners and professionals entering the crypto ecosystem.

5. Risks of Using Stablecoins

While Stable digital currencies appear safe, they come with several risks investors should understand:

- Regulatory Uncertainty: Governments are still developing frameworks for digital assets.

- Reserve Transparency: Not all issuers disclose full reserve details or audits.

- Smart Contract Risk: Decentralized Crypto-backed currencies rely on code that could be exploited.

- Market Liquidity: In extreme conditions, redemption delays or de-pegging can occur.

- Interest Rate Volatility: For yield-bearing versions, returns can fluctuate significantly.

Understanding these risks allows users to choose Stable digital currencies that balance safety, performance, and transparency.

6. How to Access Stablecoins

Accessing Crypto-backed currencies has become easier and safer than ever. They’re available on nearly every major crypto exchange and wallet platform.

To start:

- Choose a reliable provider — such as USDC, DAI, or EURC.

- Buy or convert crypto — exchange your BTC or ETH for Crypto-backed currencies.

- Store securely — in a non-custodial wallet or exchange account.

- Use them — for trading, saving, or earning yield in DeFi protocols.

Users can also find Stablecoins linked to real-world assets (RWAs), offering exposure to traditional investments like treasury bills while keeping crypto flexibility.

7. The Future of Stablecoins

The future of Stablecoins in 2025 and beyond looks promising. As the lines blur between traditional finance and blockchain, these digital assets could become the backbone of programmable money.

Expect to see:

- Central Bank Integration: More nations exploring stablecoin-compatible payment systems.

- Enhanced Regulation: Clearer standards boosting institutional confidence.

- Real-World Utility: Expansion into e-commerce, remittances, and everyday transactions.

Crypto-backed currencies are not just another crypto trend — they’re evolving into a global financial standard that merges transparency, accessibility, and innovation.

Conclusion

In 2025, Stablecoins represent more than stability — they embody the future of finance. Offering liquidity, transparency, and yield opportunities, they empower users to engage with crypto in a safe and predictable way.

While investors must remain aware of regulatory and technical risks, Crypto-backed currencies continue to serve as a bridge between decentralized finance and the global economy. As adoption accelerates, they could become the most trusted and widely used digital assets of the decade.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk