Summary

The decentralized finance (DeFi) ecosystem has revolutionized the way people interact with financial systems. By eliminating intermediaries and leveraging blockchain technology, DeFi protocols are reshaping traditional banking, lending, and investing. In this article, we explore the top blockchain finance ecosystems driving innovation, liquidity, and accessibility in 2025.

🌍 What are DeFi Protocols?

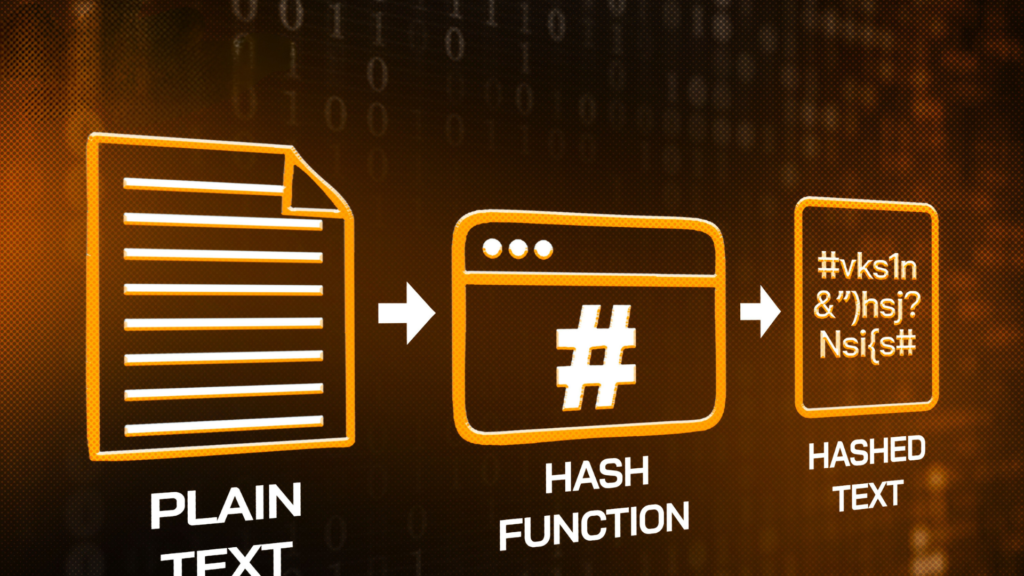

DeFi, short for decentralized finance, refers to a collection of applications and ecosystems built on blockchain networks, primarily Ethereum. These solutions allow users to trade, lend, borrow, and earn interest without relying on traditional banks. With open-source smart contracts, blockchain finance ecosystems offer transparency, security, and accessibility on a global scale.

Key features of DeFi solutions include:

- Permissionless access: Anyone with an internet connection and crypto wallet can participate.

- Transparency: All transactions are recorded on the blockchain.

- Composability: ecosystems can interact with one another to create complex financial services.

📈 Top DeFi solutions in 2025

Here are some of the most prominent blockchain finance ecosystems shaping the market:

1. Uniswap

Uniswap is the leading decentralized exchange (DEX) that allows users to swap tokens without intermediaries. Its automated market maker (AMM) model enables liquidity pools where users can provide liquidity and earn fees. Uniswap’s innovation has made it a cornerstone in Web3 finance ecosystems.

2. Aave

Aave is a decentralized lending and borrowing protocol. It introduced features such as flash loans and interest rate swaps. Aave’s flexibility and wide range of supported assets make it one of the most reliable ecosystems in blockchain financelending.

3. MakerDAO

MakerDAO powers the DAI stablecoin, which is pegged to the U.S. dollar and backed by crypto collateral. MakerDAO remains one of the oldest and most trusted blockchain finance use platforms, providing stability to the ecosystem by enabling users to mint DAI through collateralized loans.

4. Curve Finance

Curve Finance specializes in stablecoin trading. Its low-slippage AMM design makes it the go-to protocol for swapping stable assets efficiently. Curve’s governance token, CRV, plays a vital role in incentivizing liquidity providers.

5. Compound

Compound allows users to lend and borrow cryptocurrencies in a decentralized manner. Interest rates are algorithmically set based on supply and demand, making it an essential player in the blockchain finance lending market.

6. Synthetix

Synthetix enables users to trade synthetic assets that mirror real-world assets like stocks, commodities, and fiat currencies. This expands the Web3 finance ecosystem beyond cryptocurrencies and provides greater financial exposure for users.

7. Yearn Finance

Yearn Finance is an aggregator that automatically finds the best yields across blockchain finance use platforms. Its smart contracts optimize returns for liquidity providers, simplifying blockchain finance participation for investors.

8. Balancer

Balancer functions as both a DEX and an automated portfolio manager. It allows customizable liquidity pools with multiple tokens, giving liquidity providers more flexibility and control.

9. Lido Finance

Lido is a liquid staking protocol that enables users to stake Ethereum and other proof-of-stake assets while maintaining liquidity. As staking becomes more integral to blockchain networks, Lido has become a key player in the Web3 finance space.

10. PancakeSwap

Built on Binance Smart Chain (BSC), PancakeSwap offers fast, low-cost token swaps and yield farming opportunities. It remains one of the top blockchain finance use platforms outside the Ethereum network.

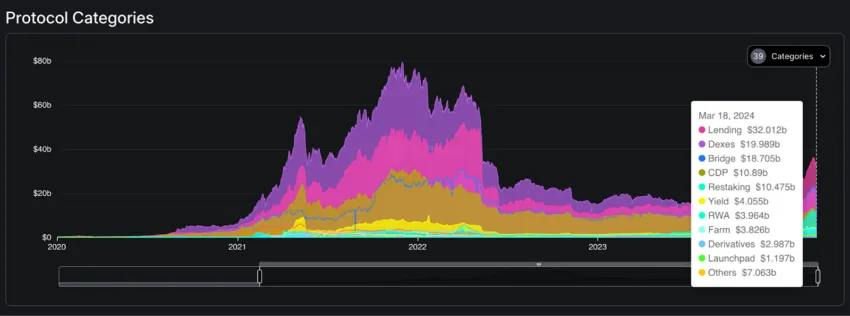

📊 The Importance of DeFi Protocols

The rapid growth of DeFi solutions highlights their importance in creating an open financial system. These use platforms:

- Empower users with full control over assets.

- Eliminate the need for centralized financial institutions.

- Foster innovation in areas like stablecoins, lending, derivatives, and staking.

- Encourage global financial inclusion.

🔧 Challenges Facing DeFi Protocols

Despite their success, DeFi solutions face several challenges:

- Security risks: Smart contract vulnerabilities and hacks remain a concern.

- Regulatory uncertainty: Governments are still defining how to regulateblockchain finance.

- Scalability: Network congestion and high gas fees affect usability.

🌟 The Future of DeFi use platforms

As blockchain technology evolves, blockchain finance solutions are expected to become more efficient, secure, and user-friendly. Layer-2 scaling solutions, cross-chain interoperability, and improved governance models will play a major role in shaping the next phase of DeFi.

Conclusion

DeFi solutions are redefining how financial services operate, making them more open, accessible, and innovative. From decentralized exchanges to liquid staking, these platforms are leading the charge toward a decentralized future. As the ecosystem matures, staying informed about the top blockchain finance solutions will be crucial for investors, developers, and users alike.

Read more: Quarterly Options Expiry Challenges Bitcoin and Ethereum with Over $14 Billion at Risk