Summary

The STABLE Act and GENIUS Act differ by only 20%, mainly in issuer requirements and state-level oversight.

Bipartisan support and the involvement of the SEC/CFTC indicate a potential unified regulatory framework on the horizon.

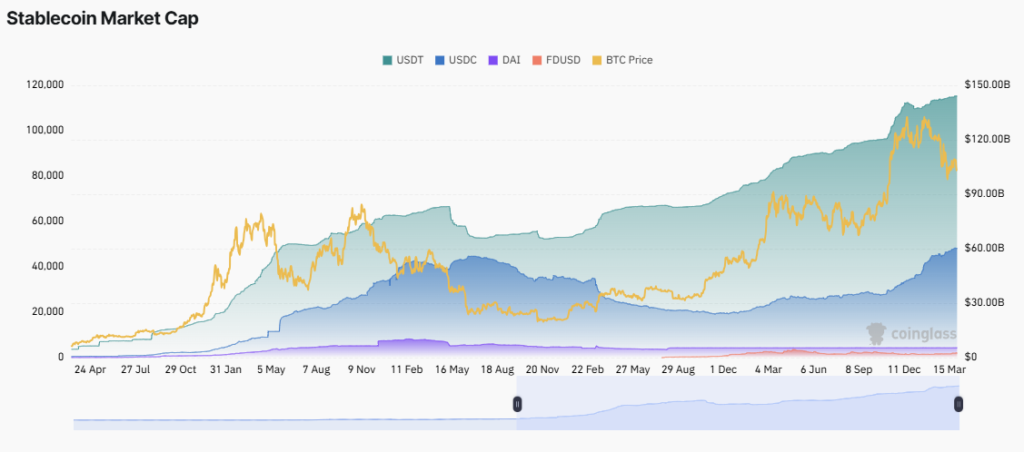

Global concerns rise as the U.S. stablecoin market surpasses $230 billion, with USDT and USDC leading the sector.

Promo

Trade on BYDFi for a chance to win an iPhone 16, Rolex watch, and more!

Alright, let’s talk about what’s happening with stablecoin bills here in the States. They’re definitely getting a lot of attention from big-money investors and politicians alike. Just recently, U.S. Representative Bryan Steil mentioned to journalist Eleanor Terrett that the two main stablecoin bills being considered – the STABLE Act and the GENIUS Act – actually aren’t that far apart.

This is good news, sparking some hope that we might get a single, clear set of rules for stablecoins pretty soon. For context, the STABLE Act came out of the House of Representatives, while the GENIUS Act is the Senate’s version.

STABLE Act and GENIUS Act Only About 20% Different

On March 31, 2025, journalist Eleanor Terrett shared details about this discussion on X (what we used to call Twitter).

According to Representative Steil, after a review session on Wednesday, the STABLE Act is looking “well-positioned to align” with the GENIUS Act once they go through a few more rounds of drafting in both the House and the Senate. He also noted that the SEC (Securities and Exchange Commission) and the CFTC (Commodity Futures Trading Commission) are chipping in with technical help.

Steil really emphasized that the roughly 20% difference between these two bills is mostly just about the wording – nothing really fundamental or deal-breaking. The main sticking points seem to be around the rules for international stablecoin companies, how much oversight states should have over these issuers, and a few small technical details. Sources and related content

He sounded optimistic about working with his Senate colleagues to push the legislation through.

“Ultimately, I think there’s recognition that we want to work with our Senate colleagues to get this across the finish line,” he said.

Getting on the same page like this is definitely a good sign. Crucially, both bills have support from Democrats and Republicans, which is a big deal given how divided Washington usually is.

NatLawReview reports that Senators Bill Hagerty, Tim Scott, Cynthia Lummis, and Kirsten Gillibrand are backing the GENIUS Act (which stands for Guidance and Establishment National Innovation for U.S. Stablecoins).

Meanwhile, the STABLE Act (short for Transparency and Responsibility for Better Ledger Economics) was put together by House Financial Services Committee Chairman French Hill and Representative Bryan Steil.

Even with some differences, the core goal of both bills is the same: setting up clear rules for issuing stablecoins, whether they’re overseen by the federal government or by the states. For instance, one difference is that the GENIUS Act tasks the Treasury Department with studying algorithmic stablecoins, whereas the STABLE Act would slap a two-year ban on issuing new ones.

If Congress manages to pass these, it could really reshape the future for stablecoins and give crypto adoption a major boost here in the States. That would be a win for investors and regular folks using this stuff day-to-day.

But, you know, not everyone’s thrilled. Experts over in Europe and China have raised some red flags. Their main worry is that if U.S. lawmakers really get behind stablecoins, it could potentially mess with the stability of their own financial systems.

All information on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger